27.4%8,46,292 Clients

Established in 2017, Paytm Money is a prominent Indian wealth management platform that leverages technology to streamline investment processes. It facilitates investments across a broad spectrum of assets, including equities, F&O, mutual funds, SIPs, IPOs, NPS, and debt instruments, offering a user-friendly experience.

Paytm Money operates as a SEBI-registered stockbroker and Investment Advisor. It is also a depository participant with CDSL and a member of both the NSE and BSE.

Initially focusing on direct mutual fund investments, Paytm Money expanded its services in the late 2020s to include pension schemes, equity trading, IPO investments, and ETFs. It further launched NSE F&O trading in 2021 and BSE F&O in 2024.

A key differentiator is the provision of free mutual fund services, incurring no charges for investment or redemption.

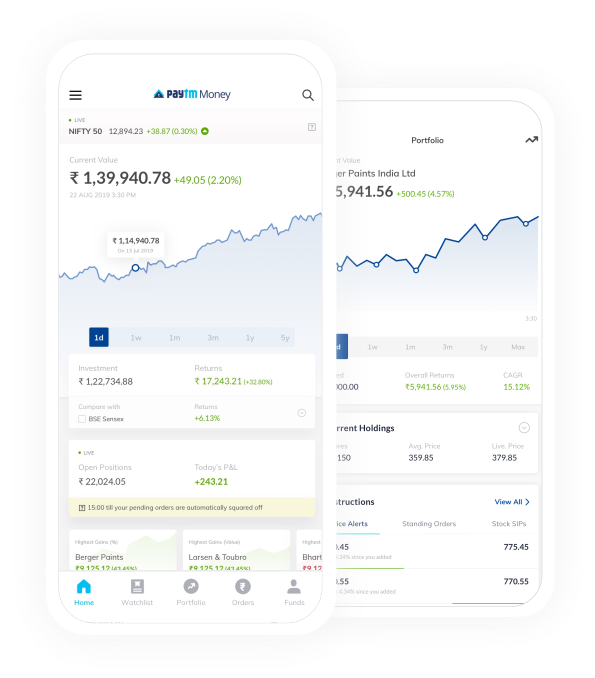

The company provides proprietary web and mobile trading applications designed for secure and seamless trading, incorporating bank-level data security.

Paytm Money is a leader in low-cost investing, serving over 27 lakh users as of May 2025.

As a SEBI-registered Research Analyst, Paytm Money offers recommendations on stock and F&O trading. It also maintains informative blogs and announcements on personal finance, capital markets, and product updates to enhance investor awareness.

Key Advantages

Key Features for Investors:

Key Features for Traders:

Beyond stocks and mutual funds, it also provides investment opportunities in ETFs, IPOs, F&O, Bonds, and NPS retirement funds.

| SEBI Registration | NSE Member code | Net Worth (In ₹ Cr.) |

|---|---|---|

| INZ000240532 | 90165 | 0.00 |

Paytm Money follows a fixed brokerage model wherein it charges a flat Rs 20 or 0.05% (whichever is lower) per executed order for intraday trading. The maximum brokerage chargeable per order across all segments is Rs 20.

|

Trading Segment |

Brokerage Charges |

|---|---|

|

Equity Delivery |

Rs 20 or 2.5% of turnover (whichever is lower) |

|

Equity Intraday |

Rs 20 or 0.05% of turnover (whichever is lower) |

|

Equity Future |

0.02% of turnover or upto Rs 20 per Executed Order (whichever is lower) |

|

Equity Options |

Rs 20 per order |

You are also required to pay other transaction and regulatory charges, Demat charges in addition to the brokerage.

Other charges levied by Paytm Money include:

VisitPaytm Money Brokerage Charges Reviewfor more detail.

Zerodha (Flat Rs 20 Per Trade)

Special Offer - Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Paytm Money offers only digital account opening to its customers. It is a simple, instant, and 100% paperless process. The company charges Rs.200 as account opening charges with zero maintenance charges. To open the trading and Demat account with Paytm Money, you need to download the Paytm Money mobile app or register yourself on the company website and complete the setup.

Paytm Money is an online broker with one branch. The company does not offer an offline account opening.

Paytm Money offers its customers to trade via mobile and web. An investor can transact seamlessly switching between the Paytm Money app and website. The company provides stockbroking services to invest across multiple asset classes like Equity, Digital gold, IPO, mutual funds, NPS, F&O, and ETF through its robust trading platforms - Paytm Money web and Paytm Money mobile application. The company also offers call and trade services to its customers. Paytm Money does not have an installable trading terminal on the desktop.

The mobile trading platform of Paytm Money allows you to trade anytime from anywhere at your fingertips. An investor has to pay Rs 300 per annum for the trading platform usage of the Cash segment. Paytm Money is a safe and secured app with a host of features like live market data, watchlist, Stock SIPs, price alerts, market depth, advanced charts, complete information about all companies, etc.

Paytm Money website platform is an online web-based trading platform that allows clients to explore stocks, mutual funds, digital gold, retirement funds, and Equity derivatives. The online trading platform helps place orders online, track transactions, invest in IPO's, and much more.

Visit Paytm Money Trading Software Review for more detail.

Zerodha (Flat Rs 20 Per Trade)

The following are the advantages of Paytm Money. You must read Paytm Money advantages and disadvantages before opening an account with Paytm Money. Paytm Money pros and cons help you find if it suits your investment needs.

The following are the cons of Paytm Money. Check the list of Paytm Money drawbacks.

| Overall Rating | |

| Fees | |

| Brokerage | |

| Usability | |

| Customer Service | |

| Research Capabilities |

Based on 53 Votes by Paytm Money Customers

Do you trade with Paytm Money? Rate Paytm Money

The number of Paytm Money customer complaint received by the exchanges. The Paytm Money consumer complaint report helps understanding the Paytm Money quality and relibility of service.

| Exchange | Financial Year | Number of Clients* | Complaints** | % |

|---|---|---|---|---|

| BSE | 2025-26 | 289151 | 13 | 0.0045 % |

| NSE | 2025-26 | 846292 | 180 | 0.0213 % |

| BSE | 2024-25 | 308122 | 8 | 0.0026 % |

| NSE | 2024-25 | 664294 | 354 | 0.05 % |

| BSE | 2023-24 | 346480 | 78 | 0.02 % |

| NSE | 2023-24 | 797157 | 188 | 0.02 % |

| BSE | 2022-23 | 240904 | 47 | 0.02 % |

| NSE | 2022-23 | 646387 | 238 | 0.03 % |

| BSE | 2021-22 | 103182 | 18 | 0.02 % |

| NSE | 2021-22 | 404376 | 74 | 0.01 % |

* The number of active customers reported by the broker.

** The total number of complaints received against the broker at the given exchange.

Visit Paytm Money Complaints at BSE, NSE and MCX for detail report.

Paytm Money is a low-cost online discount broker providing investment offerings in mutual funds, stocks, IPO, NPS, Digital gold and, Derivatives. Paytm Money charges Rs 200 for account opening and has zero maintenance charges.

To avail of the services offered by the company, you need to open a Trading and a Demat account with Paytm Money. The Demat account gets linked to your trading account. You also need to register one of your bank account details for seamless transactions. Once all the accounts are ready, you can trade with Paytm Money through any of the Paytm Money trading platform offered via the web or mobile app.

Paytm Money does not provide tips or recommendations for stocks. The company maintains all the necessary information of a company that helps to perform self-research analysis. Paytm Money is a SEBI registered Investment Advisor providing advisory services for mutual funds.

Paytm Money follows a flat fee model. It charges a lower of Rs 10 or 0.05% of trade value for Equity Intraday trades and flat Rs 10 for F&O transactions. The company offers free Equity Delivery trading.

Being an online discount broker, Paytm Money offers only online trading services to its customers. The company has no customer branch support. It relies heavily on the usage of technology to serve its customers.

Paytm Money is an online discount broker offering low-cost services to its customers. Paytm Money follows a simple pricing model based on the flat fee model.

| Segment | Brokerage Fee |

|---|---|

|

Equity Delivery |

Rs 0 (Free - Minimum Rs 0.01 per executed order) |

|

Equity Intraday |

Rs 10 per executed order or 0.05% whichever is lower |

|

Equity Futures |

Rs 10 per executed order |

|

Equity Options |

Rs 10 per executed order |

An investor has to pay other regulatory and transaction charges like STT, exchange transaction charges, GST, Stamp Duty over and above the brokerage.

Paytm Money offers a proprietary trading platform to its investors in the name of Paytm Money. Paytm Money trading platform is available on the web and as a mobile app. The company also offers call and trade services to its investors.

Paytm Money Trading platform

Paytm Money app is a mobile app by Paytm Money that is available for Android and Apple smartphones.

Paytm Money website is a web-based trading platform that can be accessed from any desktop, laptop, computer, or phone that has a web browser installed on it.

Paytm Money is a low-cost broker with commission-free investing in mutual funds. The company charges Rs 200 for account opening and has zero maintenance charges. Paytm Money has a simple pricing model with free Equity Delivery trading. The mutual fund investment at Paytm Money is free with no transaction charges or redemption charges.

Paytm Money is a SEBI registered broker and an Investment Advisor. The company is a member of NSE and BSE and has a depository participant with CDSL.

Paytm Money provides simple, safe, secure, and robust trading platforms under the brand name of Paytm Money in web and mobile versions.

Paytm Money is one of the fastest-evolving investment platforms in India. The company adds new products and features at short and regular intervals and soon aims to be a one-stop-shop for millions of India for financial services.

Overall, Paytm Money is a good broker that believes in investor first approach.

Read How safe is Paytm Money? for more details.

To start investing with Paytm Money, you need to open a trading and Demat account with Paytm Money either through the web or mobile app as a first step. Once the trading and Demat accounts are ready, you need to login into your account and start investing.

To invest in mutual funds, you need to go to the mutual funds' tab and click on Invest. Choose the desired mutual fund based on your risk profile by applying various filters and make the payment either through SIP or lumpsum mode as available for the selected scheme.

To invest in Stocks, go to the Stocks tab and click on Invest. Select the stock you need to buy or sell and place the order by inputting the desired quantity. You can place a Delivery or an Intraday order at market price or custom price. Before placing the order, ensure to have the required funds or securities in your account.

No, Paytm Money is not a Chinese app. It is an Indian app owned by the Indian company One97 Communications Limited.

Though it is not a Chinese company, it has received funding from Ant Financials that is a part of China's Alibaba group.

Paytm Money account (trading and demat) can be closed easily by submitting an account closure request. Note that the account closure request has to be couriered in paper format. The Paytm Money account cannot be closed online, by phone or by email.

Steps to delete/close the Paytm Money account:

Please make sure there are no securities or outstanding due on your account before initiating the account closure request.

Paytm Money is a stock trading service of the Paytm app. It is one of the low-cost online discount brokers in India. The company offers brokerage-free Equity Delivery trading and mutual fund investments. Paytm Money is a registered member of SEBI, BSE, NSE, and CDSL.

Paytm Money is good for stock market investors who can buy and sell stocks online by themselves with no help from the broker. Paytm offers a mobile trading app and trading website. Unlike full-service brokers, Paytm money doesn't offer local branch support, research & recommendations, RM support and wealth management products.

Paytm Money offers to invest across multiple asset classes like ETF, IPO, F&O, and NPS retirement funds other than Stocks and MF. The company provides trading platforms at an annual charge of Rs 300 through mobile and web platforms for safe and secured trading.

The maximum brokerage charged by the broker for Equity Intraday and F&O is Rs 10 per executed order.

Yes, Paytm Money is a SEBI registered discount broker and a member of NSE and BSE. The company offers online trading and investment services to its customers.

Paytm Money is a stock broker. It was incorporated in September 2017. It offers to trade in Equity, F&O, Mutual Funds, IPO, and NPS Retirement Funds. It is a wholly-owned subsidiary of Paytm, India's largest digital goods and mobile platform.

Paytm Money is also a SEBI registered Investment Advisor, a depository participant member of CDSL, and a Pension Fund Regulatory and Development Authority (PFRDA) registered point of presence to offer National Pension Services (NPS).

Paytm Money offers its customers an affiliate partner program. Under the affiliate program, customers can earn money by performing simple tasks such as recommending Paytm Money to their family, friends and contacts.

When opening an account through such referrals, customers receive rewards and profit sharing.

This feature is available every time an account is opened and any Paytm Money customer can make referrals and earn money.

Paytm Money is a SEBI registered investment advisor (IA) providing investment execution and advisory services. The company has a depository participant membership with CDSL and is also a member of NSE and BSE.

The company started with mutual funds and has since expanded its offerings to include investment securities such as equities, IPO investments and ETFs.

The broker offers its services through its online trading and investment platforms.

Intraday trades are trades where the trader does not want to hold the position overnight.

Here the trade is squared-off either by the trader himself or by the broker at the end of the trading day.

To start intraday trading with Paytm Money, please follow the steps below:

Yes, Paytm Money is a safe and trusted stock broker operating in India.

Paytm Money is registered with SEBI and provides brokerage services to its clients. It is a discount brokerage firm established in 2017. The company has a Depository Participant Membership with CDSL with the DP number 12088800.

Paytm Money's clients can invest and trade in securities such as mutual funds, equities, NPS retirement funds, and IPOs.

Paytm Money is an Investment Adviser (IA) providing investment services.

The company strives to create wealth creation opportunities for investors in India.

It originally started with only direct mutual funds, which has now expanded to several services such as equity, IPO, NPS, and Retirement Funds investment.

Paytm Money is a subsidiary of One97 Communications Ltd, which also created the Paytm brand, India's largest mobile payments and commerce platform.

When you connect with Paytm Money, you get the trust of Paytm.

All of Paytm Money's processes, from account opening to account maintenance are hassle-free and convenient. There is no physical verification or commitment required when you open a new account or place trades.

Paytm Money offers a wide range of securities for you to invest in. The investment process is very simple. Customers can invest in stocks, direct mutual funds, NPS Retirement Funds and more.

Paytm Money is a SEBI registered investment advisor (IA). It offers services like investment execution along with advisory services.

The company started this journey in 2017 after the success of Paytm, a mobile payment and trading platform.

Paytm Money offers a variety of investments for customers to choose from.

Originally, the company started with direct investments in mutual funds. With Paytm Money, there are no commissions or fees for investing in mutual funds.

Information on this page was last updated on Wednesday, November 22, 2023

Zerodha (Flat Rs 20 Per Trade)

Special Offer - Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Compare brokers side-by-side to choose the right one.

Are you a Paytm Money Customer?