Bookbuilding IPO | ₹10,341 Cr | Listed at BSE, NSE

SBI Cards IPO is a book build issue of ₹10,340.79 crores. The issue is a combination of fresh issue of 0.66 crore shares aggregating to ₹499.32 crores and offer for sale of 13.05 crore shares aggregating to ₹9,841.46 crores.

SBI Cards IPO bidding started from Mar 2, 2020 and ended on Mar 5, 2020. The allotment for SBI Cards IPO was finalized on Mar 11, 2020. The shares got listed on BSE, NSE on Mar 16, 2020.

SBI Cards IPO price band is set at ₹755 per share. The lot size for an application is 19. The minimum amount of investment required by an retail is ₹14,345 (19 shares) (based on upper price). The lot size investment for sNII is 14 lots (266 shares), amounting to ₹2,00,830, and for bNII, it is 70 lots (1,330 shares), amounting to ₹10,04,150.

The issue includes a reservation of up to 18,64,669 shares for employees offered at a discount of ₹75.00 to the issue price.

Axis Capital Ltd. is the book running lead manager and MUFG Intime India Pvt.Ltd. is the registrar of the issue.

Refer to SBI Cards IPO RHP for detailed Information.

IPO Open

Mon, Mar 2, 2020

IPO Close

Thu, Mar 5, 2020

Issue Price

₹755 per share

Market Cap (Pre-IPO)

₹70,890.00 Cr

| IPO Date | 2 to 5 Mar, 2020 |

| Listed on | Mon, Mar 16, 2020 |

| Face Value | ₹10 per share |

| Price Band | ₹750 to ₹755 |

| Issue Price | ₹755 per share |

| Lot Size | 19 Shares |

| Sale Type | Fresh Capital & OFS |

| Issue Type | Bookbuilding IPO |

| Listing At | BSE, NSE |

| Employee Discount | ₹75.00 |

| Total Issue Size | 13,71,49,314 shares (agg. up to ₹10,341 Cr) |

| Fresh Issue | 66,22,516 shares (agg. up to ₹499 Cr) |

| Offer for Sale | 13,05,26,798 shares of ₹10 (agg. up to ₹9,841 Cr) |

| Share Holding Pre Issue | 93,23,34,278 shares |

| Share Holding Post Issue | 93,89,56,794 shares |

| BSE Script Code / NSE Symbol | 543066 / SBICARD |

| ISIN | INE018E01016 |

SBI Cards IPO offers total 13,71,49,314 shares. Out of which 6,11,15,982 (44.56%) allocated to QIB, 2,44,46,393 (17.82%) allocated to QIB (Ex- Anchor), 1,83,34,795 (13.37%) allocated to NII 4,27,81,188 (31.19%) allocated to RII and 3,66,69,589 (26.74%) allocated to Anchor investors.

| Investor Category | Shares Offered | Max Allottees |

|---|---|---|

| QIB Shares Offered | 6,11,15,982 (44.56%) | NA |

| − Anchor Investor Shares Offered | 3,66,69,589 (26.74%) | NA |

| − QIB (Ex. Anchor) Shares Offered | 2,44,46,393 (17.82%) | NA |

| NII (HNI) Shares Offered | 1,83,34,795 (13.37%) | NA |

| Retail Shares Offered | 4,27,81,188 (31.19%) | 22,51,641 |

| Employee Shares Offered | 18,64,669 (1.36%) | NA |

| Shareholders Shares Offered | 1,30,52,680 (9.52%) | NA |

| Total Shares Offered | 13,71,49,314 (100.00%) |

Investors can bid for a minimum of 19 shares and in multiples thereof.

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 19 | ₹14,345 |

| Retail (Max) | 13 | 247 | ₹1,86,485 |

| S-HNI (Min) | 14 | 266 | ₹2,00,830 |

| S-HNI (Max) | 69 | 1,311 | ₹9,89,805 |

| B-HNI (Min) | 70 | 1,330 | ₹10,04,150 |

SBI Cards IPO raises ₹2,768.55 crore from anchor investors. SBI Cards IPO Anchor bid date is February 28, 2020.

📝 Anchor Investors Letter (PDF)

| Bid Date | Fri, Feb 28, 2020 |

| Shares Offered | 3,66,69,589 |

| Anchor Portion (₹ Cr.) | 2,768.55 |

| Anchor lock-in period end date for 50% shares (30 Days) | Fri, Apr 10, 2020 |

| Anchor lock-in period end date for remaining shares (90 Days) | Tue, Jun 9, 2020 |

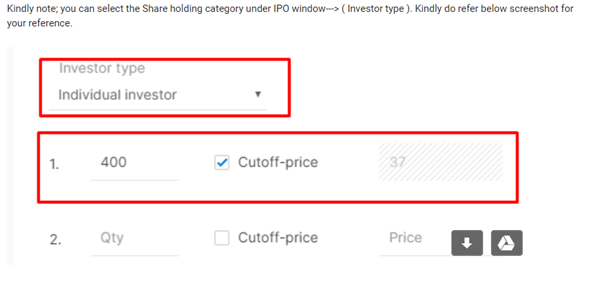

| Application Category | Maximum Bidding Limits | Bidding at Cut-off Price Allowed |

|---|---|---|

| Only RII | Up to Rs 2 Lakhs | Yes |

| Only sNII | Rs 2 Lakhs to Rs 10 Lakhs | No |

| Only bNII | Rs 10 Lakhs to NII Reservation Portion | No |

| Only shareholder | Up to Rs 2 Lakhs | Allowed only if bidding amount is upto Rs 2 lakhs |

| Only employee | Yes | |

| Employee + Shareholder |

|

Yes |

| Employee + Shareholder + RII/NII |

|

Yes for shareholder/employee/RII |

| Shareholder + RII/NII |

|

Yes for shareholder/RII |

| Employee + RII/NII |

|

Yes for shareholder/RII |

Note: To be eligible for the Shareholder Quota, you must hold shares in one of the following companies:

Incorporated in 1998, SBI Cards and Payment Services Limited is a subsidiary of SBI, India's largest commercial bank in terms of deposits, advances and the number of branches. SBI currently holds (along with its nominees) 689,927,363 Equity Shares, constituting to 74.00 % of the pre-Offer issued, subscribed and paid-up Equity Share capital of the Company.

The company the 2nd largest credit card issuer in the country, with a 17.6% and 18.1% market share of the Indian credit card market (number of credit cards) as of March 31, 2019, and November 30, 2019, respectively, and a 17.1% and 17.9% market share of the Indian credit card market ( total credit card spends) in fiscal 2019 and in the eight months ended November 30, 2019.

SBI Cards offers a wide range of credit cards to individual and corporate clients including lifestyle, rewards, shopping, travel, fuel, banking partnership cards, and corporate cards, etc.

SBI Cards has partnered with several leading names across industries, including Air India, Apollo Hospitals, BPCL, Etihad Guest, Fbb, IRCTC, OLA Money and Yatra, amongst others.

As a subsidiary of SBI, the company has access to SBI's extensive network of 21,961 branches across India. The partnership enables it to market its cards to a huge customer base of 445.5 million customers.

Headquartered in New Delhi, as of December 31, 2019, the company has a sales force of 38,677 outsourced sales personnel operating out of 145 Indian cities.

The company's total income increased at a CAGR of 44.9% and the revenues from operations have increased at a CAGR of 44.6% between fiscal 2017 to 2019. The net profit grew at a CAGR of 52.1% during the period.

Competitive Strengths

1. 2nd largest credit card issuer in India with a strong track record of growth and profitability.

2. Leading player in open market customer acquisitions using physical and digital channels in India.

3. A well-known promoter in SBI with strong brand recognition.

4. Diversified credit card portfolio and partnerships with leading brands across industries.

| Period Ended |

|---|

| Amount in ₹ Crore |

The Company proposes to utilise the Net Proceeds from the Issue towards the following objects:

| # | Issue Objects | Est Amt (₹ Cr.) |

|---|---|---|

| 1 | Augment our capital base to meet our future capital requirements |

| Pre IPO | Post IPO | |

|---|---|---|

| P/E (x) | 45.8 | |

| Promoter Holding | 74% | 69.51% |

| Market Cap | ₹70,890.00 Cr. |

Investors who hold SBI shares on the 18th Feb 2020 (the date of filing RHP with SEBI) are eligible to apply under the shareholder's category of SBI Cards IPO. As per RHP, the SBI shareholders can apply above Rs 2 lakh and maximum up to reserved poprtion for the SH category. SBI shareholders (bidding up to Rs 2 lakhs) can also apply under the retail category. Further, if an SBI shareholder is also an SBI employee, he/she is also eligible to apply in all the three categories- RII (up to Rs 2 lakhs), Shareholder (up to Rs 2 lakhs) and Employees (up to Rs 5 lakhs).

Continue reading about SBI Cards IPO Shareholders Application Detail

Full-time or permanent employees of SBI (as on RHP filing date) can apply in the SBI Employees category of SBI Cards IPO. The maximum limit defined to apply in the Employee category is Rs 5 lakhs. The maximum allotment to employees cannot be above Rs 2 lakhs when the category is fully or oversubscribed. In case of under-subscription in the employee category, the unsubscribed portion will be available for allocation, proportionately to all Eligible Employees who Bid above Rs 2 lakhs, subject to maximum limit not exceeding Rs 5 lakhs.

Continue reading about SBI Cards IPO Employees Application - Explained

Note:

| # | Issue Expenses | Est Amt (₹ Cr.) |

|---|---|---|

| 1 | Fees payable to the BRLMs | 48.34 |

| 2 | Advertising and marketing expenses | 25.41 |

| 3 | Fees payable to the Registrar to the Offer | 7.25 |

| 4 | Brokerage and selling commission payable to Syndicate, Registered Brokers, RTAs and CDPs,as applicable | 15.85 |

| 5 | Processing fees to the SCSBs and fees to the Sponsor Bank for ASBA Forms procured by Registered Brokers, RTAs or CDPs | 6.66 |

| 6 | Printing and distribution of issue stationery | 6.34 |

| 7 | Fees to regulators, including stock exchanges | 7.51 |

| 8 | SEBI, BSE and NSE processing fees, book building and listing fees and other regulatory expenses; | 7.58 |

| 9 | Fees payable tolegal counsels | 4.07 |

| 10 | Miscellaneous | 9.74 |

| Price Details | BSE | NSE |

|---|---|---|

| Final Issue Price | ₹755.00 | ₹755.00 |

| Open | ₹658.00 | ₹661.00 |

| Low | ₹658.00 | ₹656.00 |

| High | ₹755.00 | ₹755.00 |

| Last Trade | ₹683.20 | ₹681.40 |

Lead Manager Reports

SBI Cards & Payment Services Ltd is coming up with an initial public offer of around Rs 10,000 Cr to offer an exit to the existing shareholders, expand the capital base and get listed at BSE and NSE stock exchanges.

The SBI Card IPO opens on Mar 2, 2020, and closes on Mar 5, 2020. The bidding closes for retail investors on March 5, 2020, at 5 PM.

The SBI Card IPO price and lot size are not yet announced. They are expected to be announced on or before Feb 26, 2020.

SBI Card IPO also has a reserved quota for SBI employees. SBI employees can apply up to Rs 5L under employee quota in addition to Rs 2L in retail and Rs 2L in shareholders' quota.

The SBI Card IPO shareholder quota cut-off date is Aug 18, 2020. Investors who have SBI shares in their demat account on this date are eligible to apply in the reserved shareholder's category.

SBI card IPO shares are proposed to list at BSE and NSE. Its expected listing date is Mar 16, 2020.

There are two ways to buy SBI Card IPO shares:

The net-banking facility of popular banks offers an Online IPO application. If you have your account with banks like SBI, ICICI, HDFC, PNB, Axis, Kotak, you can easily apply in SBI Card IPO online.

Most top share brokers in India including Zerodha, Edelweiss, Sharekhan, and 5paisa offer UPI payment gateway based online IPO application. If you have an account with a broker who offers an online IPO application, you could easily apply in IPO though them.

SBI Cards IPO lot size is 19 shares and prince band is Rs 750 to Rs 755.

An individual can also apply in the Shareholders category (any amount) if he holds the State Bank of India (SBI) shares in his demat account on the day of filing the SBI Card IPO RHP with SEBI. For SBI Card the date of filing RHP with SEBI is awaited.

SBI shareholders can apply in both; RII or NII as well as shareholder category with the maximum limit of Rs 200,000 in shareholders category.

Please note an eligible SBI shareholder bidding in SBI shareholder reservation portion (subject to bid amount not exceeding Rs 2,00,000 under SBI shareholder reservation portion) may also bid under net offer i.e. either in Retail Individual Bidders Portion for upto Rs 200,000 OR in Non-Institutional Bidders Portion such that the Bid Amount exceeds Rs 200,000 but not exceeding the size of the Net Offer (excluding QIB portion), subject to applicable limits.

An SBI Shareholders bidding in the SBI Shareholders Reservation Portion above Rs 200,000 cannot Bid in the Net Offer as such Bids will be treated as multiple Bids.

The maximum bid amount when applying in both Retail and Shareholders Category is:

An eligible SBI shareholder bidding in SBI shareholder reservation portion (subject to bid amount not exceeding Rs 2,00,000 under SBI shareholder reservation portion) may also bid under net offer i.e. either in Retail Individual Bidders Portion for upto Rs 200,000 OR in Non-Institutional Bidders Portion such that the Bid Amount exceeds Rs 200,000 but not exceeding the size of the Net Offer (excluding QIB portion), subject to applicable limits.

In SBI Shareholders bidding in the SBI Shareholders Reservation Portion above Rs 200,000 cannot Bid in the Net Offer as such Bids will be treated as multiple Bids.

Your bids can be rejected in SBI Card IPO considering multiple bids in the following cases:

Eligible Employees can bid under all 3 categories of SBI Card IPO:

An SBI shareholder and employee of SBI can apply in all three categories. A spate IPO application should be used for each of these categories.

* Retail application is considered as RII or NII category based on the amount in application. Amount < Rs 2L is considered as RII and above Rs 2L is NII.

Minimum 1 share of SBI should be in your demat account on February 18, 2020, to be eligible for applying in shareholders category of SBI Cards IPO. Feb 18 is the cut-off date for eligibility. The IPO application should be on the name of the primary demat account holder.

The cut-off date for eligible SBI Cards shareholders is Feb 18, 2020. You should have at least 1 share in your demat account on Feb 18, 2020, to be eligible to apply for IPO shares in the SBI Card IPO Shareholders category.

Zerodha customers can apply in SBI Card IPO using UPI as a payment gateway from the Zerodha Console application. Follow the below steps to buy SBI Card IPO through Zerodha:

SBI Card IPO RHP point 24 on page 416 'Do not submit a Bid cum Application Form with third-party UPI ID or using a third-party bank account (in case of Bids submitted by Retail Individual Investors using the UPI Mechanism)'

The 3rd party IPO application (with different primary account holder in demat and bank) are permitted. But only a few banks like SBI Net Banking offer this. Private banks like ICICI, HDFC, etc do not offer this facility.

For example:

SBI Cards IPO is a main-board IPO of 13,71,49,314 equity shares of the face value of ₹10 aggregating up to ₹10,341 Crores. The issue is priced at ₹755 per share. The minimum order quantity is 19.

The IPO opens on Mon, Mar 2, 2020, and closes on Thu, Mar 5, 2020.

MUFG Intime India Pvt.Ltd. is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Zerodha customers can apply online in SBI Cards IPO using UPI as a payment gateway. Zerodha customers can apply in SBI Cards IPO by login into Zerodha Console (back office) and submitting an IPO application form.

Steps to apply in SBI Cards IPO through Zerodha

Visit Zerodha IPO Application Process Review for more detail.

The SBI Cards IPO opens on Mon, Mar 2, 2020 and closes on Thu, Mar 5, 2020.

SBI Cards IPO lot size is 19, and the minimum amount required for application is ₹14,345.

You can apply in SBI Cards IPO online using either UPI or ASBA as a payment method. ASBA IPO application is available in the net banking of your bank account. UPI IPO Application is offered by brokers who don't offer banking services. Read more detail about applying IPO online through Zerodha, Upstox, 5Paisa, Nuvama, HDFC Bank, and SBI Bank.

The finalization of Basis of Allotment for SBI Cards IPO will be done on Wednesday, March 11, 2020, and the allotted shares will be credited to your demat account by Fri, Mar 13, 2020. Check the SBI Cards IPO allotment status.

The SBI Cards IPO listing date is on Mon, Mar 16, 2020.