Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

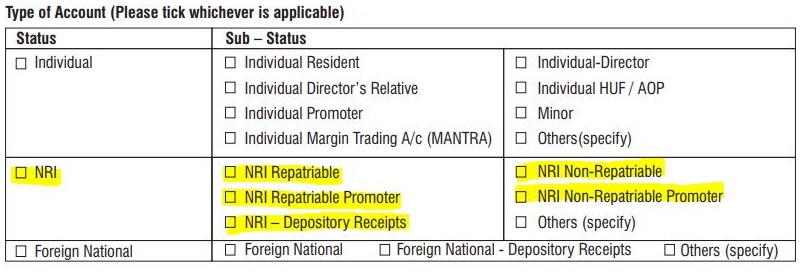

A demat account in India with sub-status as NRI Repatriable. This demat account is liked with an NRE Bank Account which is fully repatriable.

An NRI Repatriable Demat Account is an ordinary demat account with sub-status as 'NRI Repatriable'. This account is mandatory for NRIs to invest their foreign earnings in Indian Stock Market.

Read NRI Demat Account to know more.

A demat account holds securities like stocks, Mutual Funds, IPO shares, etc. in electronic form. It is similar to a bank account but instead of keeping money, it holds securities.

A demat account must be linked with an NRI Bank account. All the proceeds from selling in securities, bonuses and dividends earned, etc., are automatically credited to this linked NRE bank account.

There are 2 types of bank accounts for NRI; NRE (Non-Resident External) and NRO (Non-Resident Ordinary). An NRE bank account is opened to manage money earned abroad. The funds in the account are fully repatriable i.e. can be transferred abroad.

The NRI Repatriable Demat Account must be linked with an NRE Bank Account. This account is also called an NRE Demat Account.

As per RBI regulations, an NRI has to open 2 separate demat accounts for repatriable and non-repatriable investments.

An NRE Demat account is also called a repatriable Demat account. This is because all the proceeds from the sale of securities and gains from investments can be transferred abroad.

NRE Demat Account (Repatriable) Key Facts

Answered on

A repatriable demat account is an NRI demat account linked with an NRE bank account. All the proceeds from selling securities and profits from investments that are credited to the NRE bank account can be transferred abroad.

The demat account is an online account. It holds securities like stocks, mutual funds, ncds, bonds, etc. in electronic form. A demat account is similar to a bank account. It holds securities instead of money.

NRE demat account is for investments on a repatriation basis and the NRO demat account is for investments on a non-repatriation basis. NRE demat is linked with NRE Bank Account (PIS or Non-PIS) whereas the NRO Demat is linked with the NRI Non-PIS account.

|

NRE demat account |

NRO demat account |

|

|---|---|---|

|

Purpose |

For investments on repatriation basis |

For investments on non-repatriation basis |

|

Type of linked bank account |

NRE Bank Account |

NRO Bank Account |

|

Repatriation of Funds |

Full Repatriable |

The principal amount is repatriable after taxation. You can transfer up to USD 1 million in a financial year. Interest earned is repatriable. TDS is deducted. |

The transfer of shares from an NRE Demat Account to NRO Demat Account is not permitted. Shares purchased under PIS (NRE demat account) shall be sold on stock exchange only. Such Shares cannot be transferred.

Note:

Both of these accounts have different compliance, tax obligations, and repatriability.

An NRI Demat account can be opened by approaching any bank, stockbroker, or depository participant (DP).

An NRI is required to fill in the Demat account opening form and submit/send it to the respective office along with the below documents and account opening fees.

The documents submitted should be self-attested and notarized by an Indian embassy or any other competent authority. Kindly note that the above documents are a generic list for reference and the actual requirement may differ a bit based on the broker, bank, or DP.