Compare Trading Platform ODIN and Fyers One. Find similarities and differences between ODIN and Fyers One Trading Softwares. Find the most powerful trading platform. Find which trading software is better among ODIN and Fyers One.

| ODIN | Fyers One | |

|---|---|---|

| ||

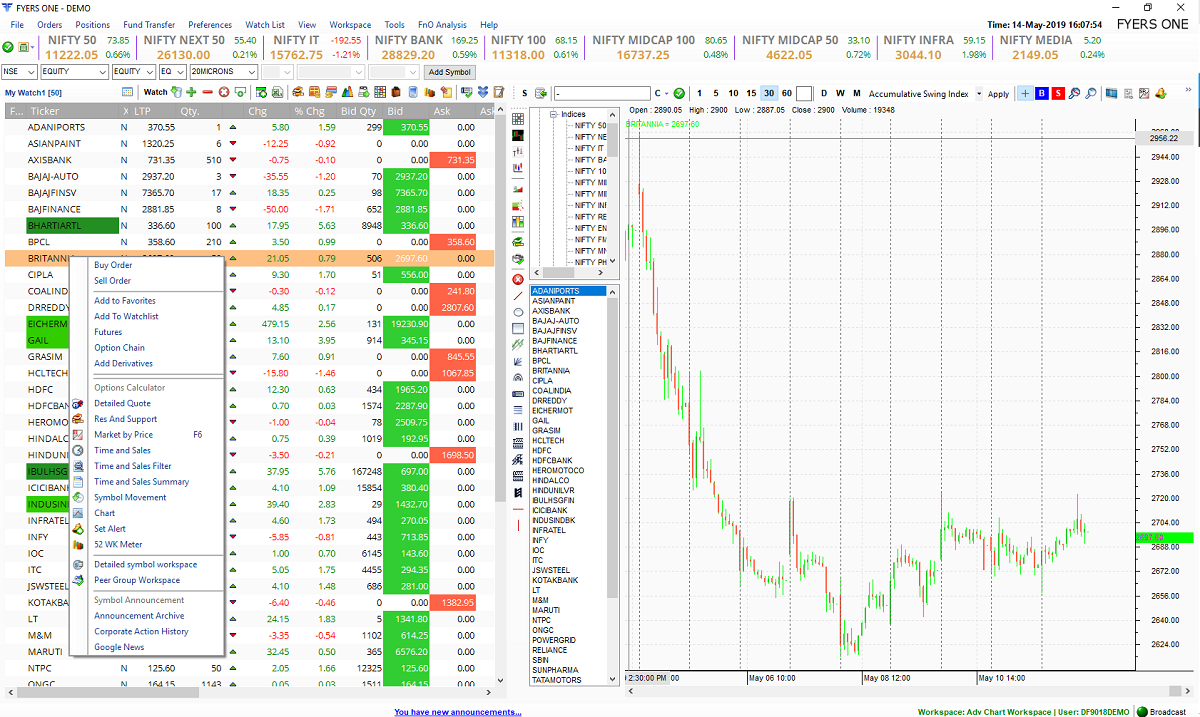

| About Trading Platform | 63 moons is a financial service company offering its services in the area including Exchange Technology Solutions, Brokerage Technology Solutions, and Risk Solutions. Company's flagship product ODIN is among the leading trading platforms in India. ODIN offers end-to-end online trading solutions to brokers in India. ODIN Trader Work Station is an integrated Dealer trading application, with real-time exchange broadcast, Order Management, Trading reports along with various Decision support and Alert generating tools inbuilt to aid the dealers in making an informed decision at the time of transactions. The uses of its software have declined sharply after the company chairman was jailed because of the fraud transactions at NSEL 2013. ODIN is still used by many top financial service providers in India and across the world. | Launched in May 2016, Fyers One is an installable trading terminal for online trading. It offers trading across multiple segments including commodity, equity cash, F&O, and currency derivatives. With advanced charting features, market scanners, technical indicators, and customizable workspace, it is a platform designed for professional traders. |

| Platform Owner | 63 moons technologies limited | Fyers securities |

| Trading Segments Offered | NSE, BSE, NSE FNO, Currency, MCX and NCDEX Commodity | Equities, Currency, Commodities and Derivatives |

| Products Offered | CNC, MIS, NRML, BTST, BO, CO, BTST, MTF | Regular, Cover Order, Bracket Order, AMO, Intraday, CNC, Margin |

| Order Type Offered | RL, SL, ST, AON, MF, MIT | Limit, Market, Stop Loss, Stop Loss Limit |

| Supported Exchanges | BSE, NSE, MCX, NCDEX | NSE, BSE, MCX |

| Brokers using this platform | Traditional Brokers:

Discount Brokers:

| Fyers Securities |

| Order Management System (OMS) | ODIN OMS | Omnesys OMS |

| Risk Management System (RMA) | ODIN RMS | Omnesys RMS |

| Trading Platform Enquiry | Open Instant Account with ODIN | Open Instant Account with Fyers One |

| ODIN | Fyers One | |

|---|---|---|

| Highlights | ODIN trading software is used by over 1000+ brokers / financial institutes in India. It is a stable, fast and a powerful trading platform for trading at BSE, NSE, and MCX. Here are a few key highlights of the ODIN Diet:

ODIN had a monopoly in the trading solutions business until 2013. The growth of the product stalled after the owner got caught in 2013 fraud at NSEL. The company's fate is in limbo as the prosecutors are trying to recover over Rs 5000 Cr. | Highlights of the Fyers One Trading Terminal are mentioned below:

|

| Features | ODIN Diet is a comprehensive trading tool. It offers to trade in equity, currency, and commodity, all under one screen and with one login. You can trade at BSE, NSE, MCX, and NCDEX. ODIN Diet is built for frequent trader and for dealers who place orders on behalf of customers. Other than the standard trading features, here are some of the key features of the ODIN Trading Platform:

|

|

| Advantages |

|

|

| Disadvantages |

|

|

| Broker Account Enquiry | Open Instant Account with ODIN | Open Instant Account with Fyers One |

| ODIN | Fyers One | |

|---|---|---|

| Installable Trading Terminal | ||

| Trading Website | ||

| Mobile Trading App | ||

| API Access | ||

| Offered by Multiple Brokers | ||

| Equity Trading | ||

| Currency F&O Trading | ||

| Commodity Trading | ||

| Online IPO Application | ||

| Online Mutual Funds | ||

| Integrated Backoffice | ||

| Open an Account | Open Instant Account with ODIN | Open Instant Account with Fyers One |

| ODIN | Fyers One | |

|---|---|---|

| Chart Types Supported | 4 | |

| Chart Indicator | 100 | 65 |

| Place Orders from Chart | ||

| Online Account Opening | Open Instant Account with ODIN | Open Instant Account with Fyers One |