Compare Trading Platform Omnesys NEST and Zerodha Kite. Find similarities and differences between Omnesys NEST and Zerodha Kite Trading Softwares. Find the most powerful trading platform. Find which trading software is better among Omnesys NEST and Zerodha Kite.

| Omnesys NEST | Zerodha Kite | |

|---|---|---|

|  | |

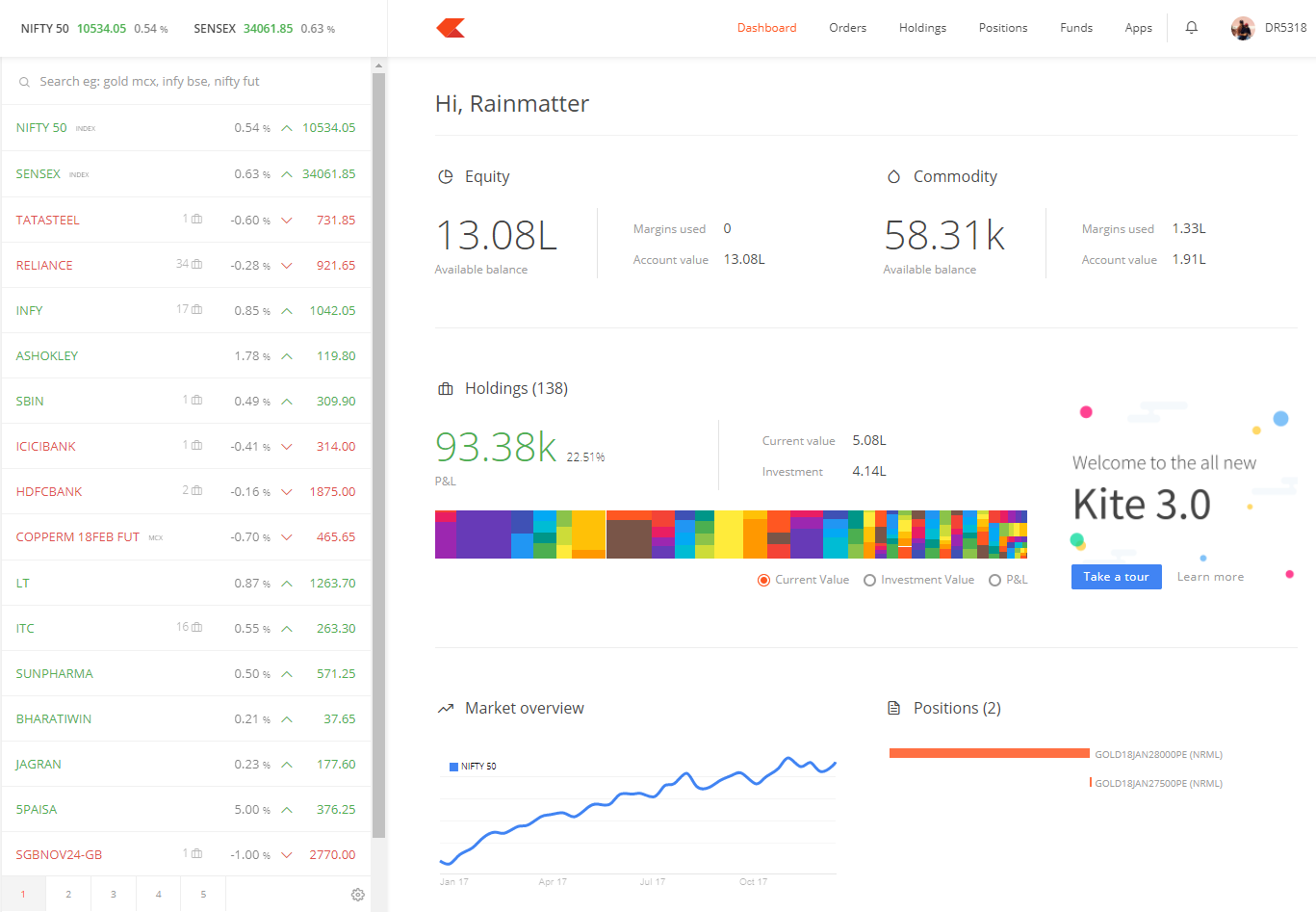

| About Trading Platform | Omnesys NEST is a stock trading platform that supports trading in equities, commodities, currency, and derivatives across multiple exchanges. Developed in-house by Omnesys Technologies, it provides a wide range of trading tools, market data, and trading solutions to institutional brokers, retail brokers, proprietary trading desks, and exchanges etc. | Kite 3.0 is an online trading platform developed in-house by Zerodha. The online platform is built using advanced technology that allows traders to trade in NSE, BSE, and MCX across various investment segments. |

| Platform Owner | Thomson Reuters International Services Private Ltd | Zerodha |

| Trading Segments Offered | Equities, Commodities, Currency, Derivatives | Stocks, Commodity, Currency, Derivatives |

| Products Offered | NEST Trader, NEST Web, NEST Mobile | Kite 3.0, Kite mobile, Kite Connect API, Q, Coin, Sentinel, smallcase, Streak |

| Order Type Offered | Limit, Market, StopLoss, StopLoss-Market | Limit, Market, StopLoss, StopLoss-Market |

| Supported Exchanges | BSE, NSE, MCX, NCDEX | BSE, NSE, MCX, MCX-SX |

| Brokers using this platform |

| Zerodha |

| Order Management System (OMS) | Omnesys NEST OMS | Omnesys OMS |

| Risk Management System (RMA) | Omnesys NEST RMS | Omnesys RMS |

| Trading Platform Enquiry | Open Instant Account with Omnesys NEST | |

| Omnesys NEST | Zerodha Kite | |

|---|---|---|

| Product Highlights | Over 200 retail brokers in India use NEST or NEST based platforms. The NEST is a fast, user-friendly and powerful trading platform for trading at BSE, NSE, and MCX. Some of the major highlights of the Omnesys NEST trading platform are:

| Some of the major highlights of Zerodha Kite trading platform are-

|

| Key Features | Omnesys NEST is a leading trading platform catering to the needs of traders in India. The platform offers integrated trading and risk management. Some of the major features of the NEST Trading Platform are:

|

Zerodha Kite offers a range of features to traders. Some of the key features are-

|

| Advantages |

|

|

| Disadvantages |

|

|

| Account Opening Enquiry | Open Instant Account with Omnesys NEST |

| Omnesys NEST | Zerodha Kite | |

|---|---|---|

| Installable Trading Terminal | ||

| Trading Website | ||

| Mobile Trading App | ||

| API Access | ||

| Offered by Multiple Brokers | ||

| Equity Trading | ||

| Currency F&O Trading | ||

| Commodity Trading | ||

| Online IPO Application | ||

| Online Mutual Funds | ||

| Integrated Backoffice | ||

| Open an Account | Open Instant Account with Omnesys NEST |

| Omnesys NEST | Zerodha Kite | |

|---|---|---|

| Chart Types Supported | 5 | 6 |

| Chart Indicator | 50 | 100 |

| Place Orders from Chart | ||

| Online Account Opening | Open Instant Account with Omnesys NEST |

Free Equity Delivery

Flat ₹10 per Trade in Intraday & F&O