Compare Trading Platform Omnesys NEST and Finvasia ScalperT. Find similarities and differences between Omnesys NEST and Finvasia ScalperT Trading Softwares. Find the most powerful trading platform. Find which trading software is better among Omnesys NEST and Finvasia ScalperT.

| Omnesys NEST | Finvasia ScalperT | |

|---|---|---|

| Product Highlights | Over 200 retail brokers in India use NEST or NEST based platforms. The NEST is a fast, user-friendly and powerful trading platform for trading at BSE, NSE, and MCX. Some of the major highlights of the Omnesys NEST trading platform are:

| Major highlights of the trading platform are-

|

| Key Features | Omnesys NEST is a leading trading platform catering to the needs of traders in India. The platform offers integrated trading and risk management. Some of the major features of the NEST Trading Platform are:

|

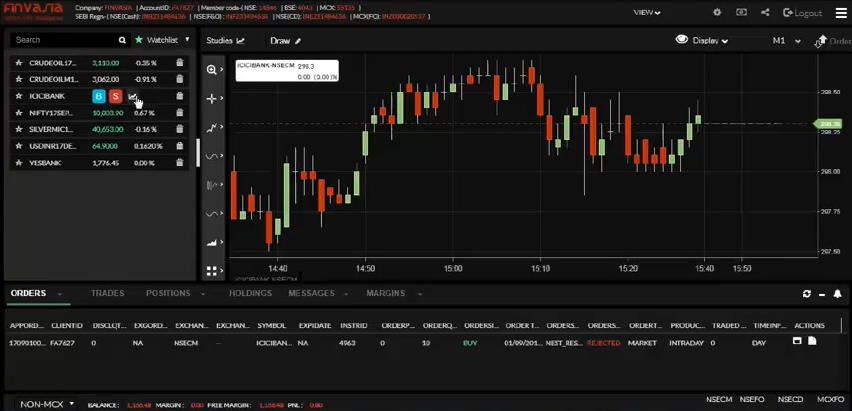

Source: Finvasia Some of the key features of the trading platform are-

|

| Advantages |

|

|

| Disadvantages |

|

|

| Account Opening Enquiry |

| Omnesys NEST | Finvasia ScalperT | |

|---|---|---|

| Installable Trading Terminal | ||

| Trading Website | ||

| Mobile Trading App | ||

| API Access | ||

| Offered by Multiple Brokers | ||

| Equity Trading | ||

| Currency F&O Trading | ||

| Commodity Trading | ||

| Online IPO Application | ||

| Online Mutual Funds | ||

| Integrated Backoffice | ||

| Open an Account |

| Omnesys NEST | Finvasia ScalperT | |

|---|---|---|

| Chart Types Supported | 5 | 12 |

| Chart Indicator | 50 | 40 |

| Place Orders from Chart | ||

| Online Account Opening |

Free Equity Delivery

Flat ₹10 per Trade in Intraday & F&O