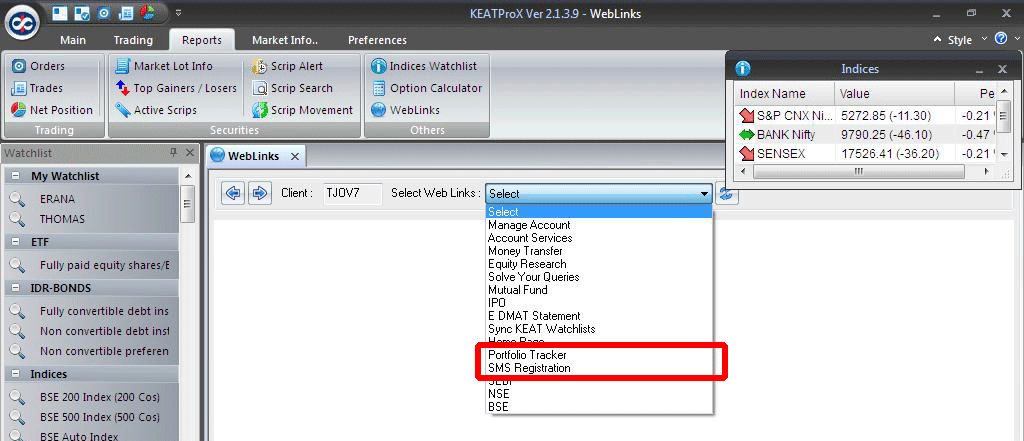

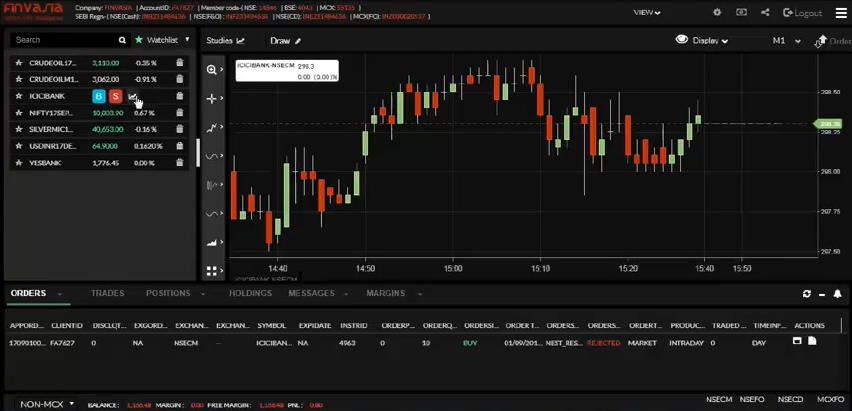

Compare Trading Platform Kotak KEAT Pro X and Finvasia ScalperT. Find similarities and differences between Kotak KEAT Pro X and Finvasia ScalperT Trading Softwares. Find the most powerful trading platform. Find which trading software is better among Kotak KEAT Pro X and Finvasia ScalperT.

| Kotak KEAT Pro X | Finvasia ScalperT | |

|---|---|---|

|  | |

| About Trading Platform | KEAT Pro X is a free, downloadable online trading software that helps traders trade in BSE, NSE and NSE currency markets. It is a high-speed trading tool that helps traders buy and sell securities, manage their portfolio, and monitor the market. | ScalperT is an in-house developed web and mobile-based trading platform. Launched in 2017, the platform can be accessed across browser and is available for Android users on mobile. |

| Platform Owner | Kotak Securities Limited | Finvasia Securities Private Limited |

| Trading Segments Offered | Equity, Derivatives, Currency, MFs, IPOs, Bonds | Stocks, Commodity, Currency, Derivatives |

| Products Offered | KEAT Pro X, Website Trading, Xtralite, FastLane, StockTrader | ScalperT Web, ScalperT Mobile App |

| Order Type Offered | Stop Loss, Limit, Market, GTC, Smart, Bracket | Normal, MIS, Stop Limit, Market, Limit, Stop, Cover, Bracket Order |

| Supported Exchanges | NSE, BSE | BSE, NSE, MCX |

| Brokers using this platform | Kotak Securities | Finvasia Securities Private Limited |

| Order Management System (OMS) | Omnesys OMS | |

| Risk Management System (RMA) | Omnesys RMS | |

| Trading Platform Enquiry | Open Instant Account with Kotak KEAT Pro X | |

| Kotak KEAT Pro X | Finvasia ScalperT | |

|---|---|---|

| Product Highlights | KEAT Pro X is used by over 13 lakh customers and more than 5 lakh trades are conducted using it. The installable trading platform facilitates trading in equities, derivatives, currency derivatives etc., in NSE and BSE. Some of the key highlights of the software are-

| Major highlights of the trading platform are-

|

| Key Features |

Source: Kotak KEAT Pro X offers a wide range of features to help traders trade with speed and ease. Some of the key features of the trading tool are-

|

Source: Finvasia Some of the key features of the trading platform are-

|

| Advantages |

|

|

| Disadvantages | The trading terminal doesn't supports commodity trading |

|

| Account Opening Enquiry | Open Instant Account with Kotak KEAT Pro X |

| Kotak KEAT Pro X | Finvasia ScalperT | |

|---|---|---|

| Installable Trading Terminal | ||

| Trading Website | ||

| Mobile Trading App | ||

| API Access | ||

| Offered by Multiple Brokers | ||

| Equity Trading | ||

| Currency F&O Trading | ||

| Commodity Trading | ||

| Online IPO Application | ||

| Online Mutual Funds | ||

| Integrated Backoffice | ||

| Open an Account | Open Instant Account with Kotak KEAT Pro X |

| Kotak KEAT Pro X | Finvasia ScalperT | |

|---|---|---|

| Chart Types Supported | 5 | 12 |

| Chart Indicator | 30 | 40 |

| Place Orders from Chart | ||

| Online Account Opening | Open Instant Account with Kotak KEAT Pro X |

Free Equity Delivery

Flat ₹10 per Trade in Intraday & F&O