-18.9%5,37,886 Clients

Established in 2000, Mirae Asset Sharekhan (formerly known as Sharekhan) is a full-service stock broking firm that is also considered as one of the pioneers in retail online broking and digital investments in India. It offers online trading and investing services for brokerage through its online trading platforms: Website (www.sharekhan.com), TradeTiger (desktop trading software), Sharekhan App and Investiger App (available for Android and iOS devices).

Designed for the Serious Investors and Traders, who believe in conducting serious research and analysis and adhering to serious discipline, Mirae Asset Sharekhan’s full-service model consists of an expert Research team, experienced Relationship Managers, wide network of branches, information-packed trading & investing platforms and educational modules.

The Mirae Asset Sharekhan NRI charges for equity trading is 0.50%. The charge for Futures is 0.1% on the first leg and 0.02% on the second leg if squared off on the same day or 0.1% if squared off on any other day. The brokerage for Options trading is Rs 250 per contract.

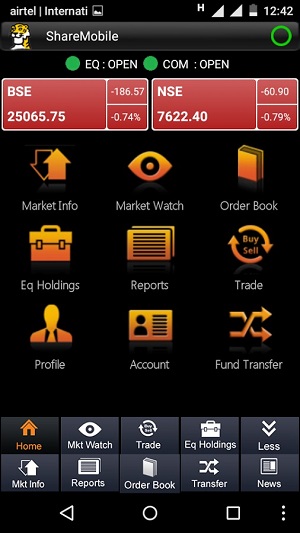

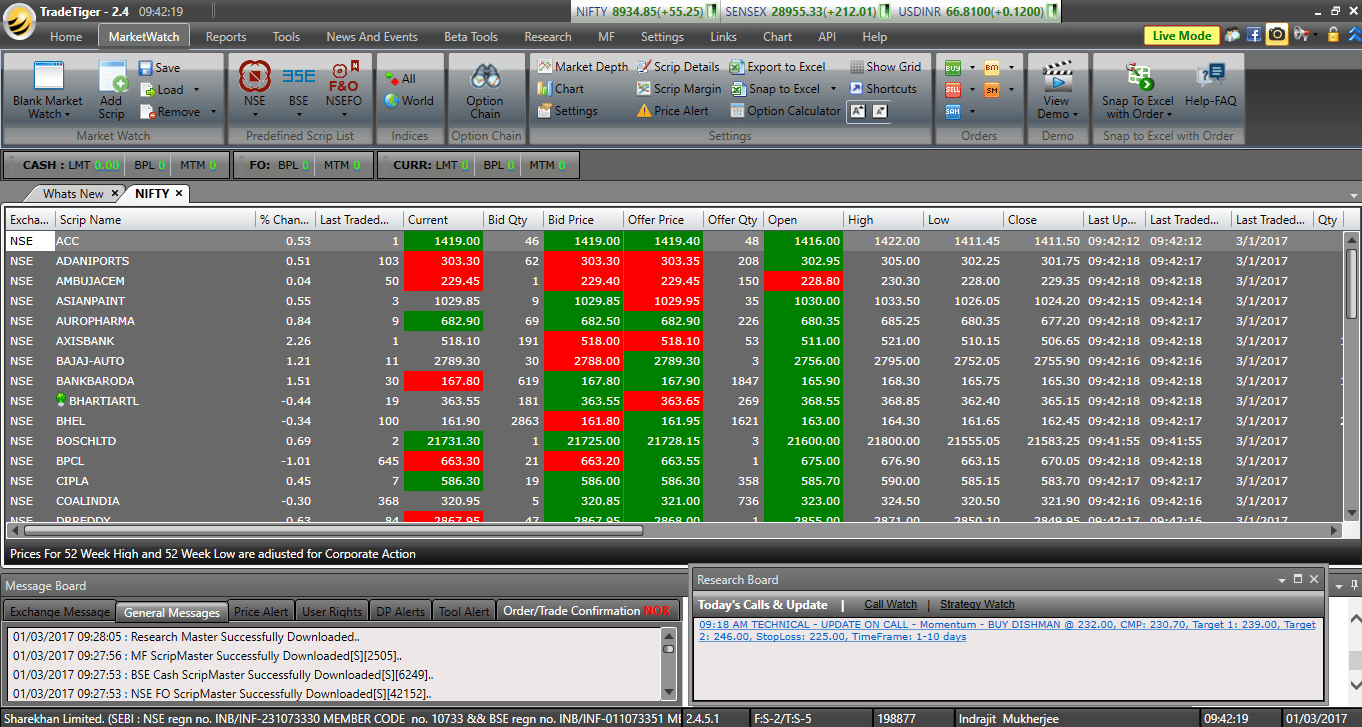

Mirae Asset Sharekhan offers a range of online trading platforms and tools. TradeTiger is its flagship trading platform. It also offers a Mobile Trading App and a website for trading.

Research is one of the key offerings of Mirae Asset Sharekhan NRI services. The company has a dedicated research team that publishes research reports to keep you updated with the latest market trends. Customers also get daily emails on current market conditions and investment recommendations.

A dedicated Relationship Managers is assigned to every NRI customer to offer personalized services.

Mirae Asset Sharekhan has partnered with California based Online Trading Academy to provide financial education investors. It offers workshops, short, intermediate and lifetime courses on various aspects of trading and investing to its customers.

Mirae Asset Sharekhan was one of the first brokers to offer online trading in India and serves over 16 lakh resident and non-resident Indians. Mirae Asset Sharekhan is one of the largest stockbrokers in India with 153 branches and over 2400 business partners across over 575 locations.

To invest through Mirae Asset Sharekhan, an NRI has to open an NRI 3-in-1 account. The 3 in 1 account is a combo account which includes 3 accounts in it:

The NRI Bank Accounts comes in two forms: NRE and NRO account. Mirae Asset Sharekhan has a partnership with 4 banks - Axis, Indusind, IDBI and HDFC Bank. You need to open an NRI bank account with one of these banks.

Mirae Asset Sharekhan NRI Demat Account is an online account to hold securities such as stocks, mutual funds, and IPO shares, etc., in electronic format. A demat account is mandatory to invest in the stock markets in India. Read NRI Demat Account to know more.

Mirae Asset Sharekhan NRI Trading Account provides you access to BSE & NSE to trade across stocks, equity derivatives, and ETFs. All stock market transactions go through a broker like Mirae Asset Sharekhan.

Note: As per RBI and FEMA regulations, NRIs need different types of trading, demat and bank accounts.

Products |

NRI Trading Accounts |

NRI Bank Accounts |

NRI Demat Account |

|---|---|---|---|

EQUITY | NRE PIS |

NRE SB & NRE PIS |

NRE DEMAT |

|

NRE PIS |

NRE SB & NRE PIS |

NRE DEMAT |

|

|

MF |

NRE NON PIS |

NRE SB |

NRE DEMAT |

|

NRE NON-PIS |

NRE SB |

NRE DEMAT |

|

|

IPO |

THROUGH ASBA |

THROUGH ASBA |

NRE OR NRO DEMAT |

|

FUTURES & OPTIONS |

NRO NON-PIS |

NRO SB |

NRO DEMAT |

Note:

Mirae Asset Sharekhan offers NRI demat account through its NSDL & CDSL membership.

Mirae Asset Sharekhan offers a completely online and fast trading experience to NRIs. Once your 3-in-1 account is opened, the step-by-step Mirae Asset Sharekhan NRI trading procedure for trading is as follows:

Transfer funds from your Axis, Indusind, IDBI or HDFC NRE/NRO bank account to your PIS Bank Account. The bank informs Mirae Asset Sharekhan on how much funds you have allocated. This is then updated as an available limit on the trading account.

Login to any of the Mirae Asset Sharekhan trading platforms and place a buy or a sell order online. If everything is alright then your order will be executed and you will receive a confirmation message.

Depending on whether it is a buy or sell order, your linked NRI bank, and NRI demat account are automatically credited or debited.

The transaction is automatically reported by Mirae Asset Sharekhan to your bank Bank for onward reporting to RBI, as per the Regulations.

Mirae Asset Sharekhan NRI brokerage charges for trading in Equity and Equity Derivatives.

| Transaction | Fee |

|---|---|

| NRI Account Opening Charges | ₹2000 |

| NRI Account AMC | ₹3000 |

| Equity Delivery Brokerage | 0.50% |

| Equity Future Brokerage | 0.1% on first leg and 0.02% on second leg |

| Equity Options Brokerage | ₹250 per contract note |

| Other Charges |

Mirae Asset Sharekhan NRI Trading Software Review

Mirae Asset Sharekhan offers a range of trading software for online trading. NRIs can also make use of AMO (After Market Hours) and GTC (Good Till Canceled) orders.

Read Mirae Asset Sharekhan Trading Software Review for an in-depth understanding of the various platforms offered by the company.

The investment options available to an NRI at Mirae Asset Sharekhan.

| Investment Option | Status |

|---|---|

| Stocks | Yes |

| Mutual Funds | Yes |

| IPO | Yes |

| Others | PMS, Wealth Management |

If you are in India, the easiest way to open an NRI account is by visiting your nearest Mirae Asset Sharekhan branch.

If you are overseas, here are the steps to open Mirae Asset Sharekhan NRI online trading account:

To open an NRI 3-in-1 Account, you need to send 2 sets (one set for Mirae Asset Sharekhan and other for the bank) of below-mentioned documents.

Note

| Feature | Status |

|---|---|

| 3-in-1 Account | No |

| Free Research and Tips | Yes |

| Automated Trading | No |

| Other Features | Call & Trade, Dedicated Relationship Manager, Branch Support |

Mirae Asset Sharekhan NRI customers can invest in mutual funds through InstaMF, an online paperless Mutual Fund investment platform. An NRI can set up a SIP or do lump sum investment in Mutual Funds.

Mirae Asset Sharekhan NRI Mutual Fund Features

Note: All AMCs don't accept investments from NRIs based in the USA and Canada due to additional compliance required as per FACTA and CRS regulations.

Mirae Asset Sharekhan NRI Support Desk contact information. Find Mirae Asset Sharekhan NRI contact number.

| Mirae Asset Sharekhan NRI Helpline | Number |

|---|---|

| Mirae Asset Sharekhan NRI Customer Care Number | +91 022 6518500 |

| Mirae Asset Sharekhan NRI Customer Care Email ID | nridesk@miraeassetsharekhan.com |

Mirae Asset Sharekhan is a good choice as a stockbroker for NRIs. It offers a full range of financial services to NRIs including a hassle-free 3-in-1 trading account, research services, investments in Mutual Funds, IPOs, NCDs and also PMS. GTC and AMO order along with Call & Trade facility help NRIs to place orders in their convenient timings.

No, the Sharekhan NRI trading account cannot be open online. However, you can request a callback by visiting the company's website and filling an inquiry form.

Sharekhan representative discusses the requirement and shares the PDF forms with you.

Sharekhan offers NRI 3-in-1 account which includes bank, trading and demat account. The bank accounts are available in partnership with Axis, HDFC, IDBI, and Indusind Banks.

The customer has to fill 2 sets of forms and attach 2 sets of supporting documents; one for bank account and another of trading and demat account.

If you are in India, you could visit any of the Sharekhan offices to open the NRI account. This is the fastest way to open an NRI account.

Sharekhan NRI trading account cannot be deactivated online. You need to close the account by filling a physical form. Sharekhan NRI trading account closure form is not available on its website for downloading. You need to contact its customer care via chat, phone or write an email to enquire about the closure process.

you must pay all pending dues and close all open positions before closing the account. Also, ensure that you have transferred all the securities you are holding to a new demat account before initiating the Sharekhan NRI trading account closure process.

Yes, Sharekhan PMS services are available for NRIs. You will have to open a PIS account as required under RBI guidelines to avail the PMS services. Sharekhan offers 2 types of PMS services to NRIs

The ProPrime Diversified Equity PMS invests for a long term to create an equity portfolio with medium to high risk.

The strategy is to identify most undervalued stocks of growing companies based on reported financial performance.

You can reach out to Sharekhan NRI customer care at:

Information on this page was last updated on Friday, February 16, 2024

Zerodha (Flat Rs 20 Per Trade)

Special Offer - Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Compare brokers side-by-side to choose the right one.

Are you a Mirae Asset Sharekhan Customer?