Understanding this document is crucial, as it contains key details like the issue price, entitlement ratio, record date, timelines, and the purpose of the fundraise, helping investors make an informed decision.

Types of Offer Letters in a Rights Issue

When a company conducts a rights issue, it prepares several versions of the offer letter to meet disclosure and communication requirements:

A preliminary version of the Letter of Offer is filed with regulatory authorities for review before the final LOF is dispatched. It contains detailed disclosures on terms, financials, and risk factors, enabling shareholders and regulators to review the offer information in advance.

Earlier, the DLOF is required to be filed with SEBI for review before the final LOF is submitted. However, following the SEBI (ICDR) Amendment Regulations, March 2025, filing a Draft Letter of Offer with SEBI is no longer mandatory for rights issues.

Now, companies can file the Letter of Offer directly with the stock exchange, though some may still do a voluntary DLOF filing for greater transparency.

The final and comprehensive offer document containing all approved details of the rights issue — including the issue size, price, entitlement ratio, timelines, business and financial information, and risk factors.

It serves as the official legal offer to shareholders and is sent electronically or made available for download through the company and stock exchange websites.

A simplified summary of the main Letter of Offer, sent to all eligible shareholders—usually along with the Application Form. It highlights key details such as the issue price, ratio, opening and closing dates, and application process.

The Abridged LOF serves as a concise reference document and directs shareholders to the full LOF (available on the company and stock exchange websites) for complete disclosures and financial details.

Rights Issue Documents (Supporting Documents)

Below are the supporting documents, which, although not types of offer letters, are crucial for shareholder participation in the rights issue. These documents enable eligible shareholders to understand their entitlements and complete the application process accurately and on time.

A communication sent to all eligible shareholders specifying their entitlement based on existing shareholdings.

It details the entitlement ratio, number of Rights Entitlements (REs) credited, ISIN of the RE, and clear instructions on how to subscribe to the rights shares or renounce (transfer) the entitlement. The RE Letter ensures shareholders are informed of their precise eligibility and the process to exercise or trade their rights.

The Application Form is the document through which shareholders apply for their entitled shares (or renounce their rights). It enables participation through ASBA or physical submission. This form is usually sent along with the Abridged Letter of Offer or made available online via the stock exchange portals.

It must be filled in accurately with details such as personal information, depository account, number of shares applied for, and payment instructions. The form allows shareholders to subscribe to their entitlement, apply for additional shares, or renounce their rights before the issue closure date.

Rights Application Form Sample

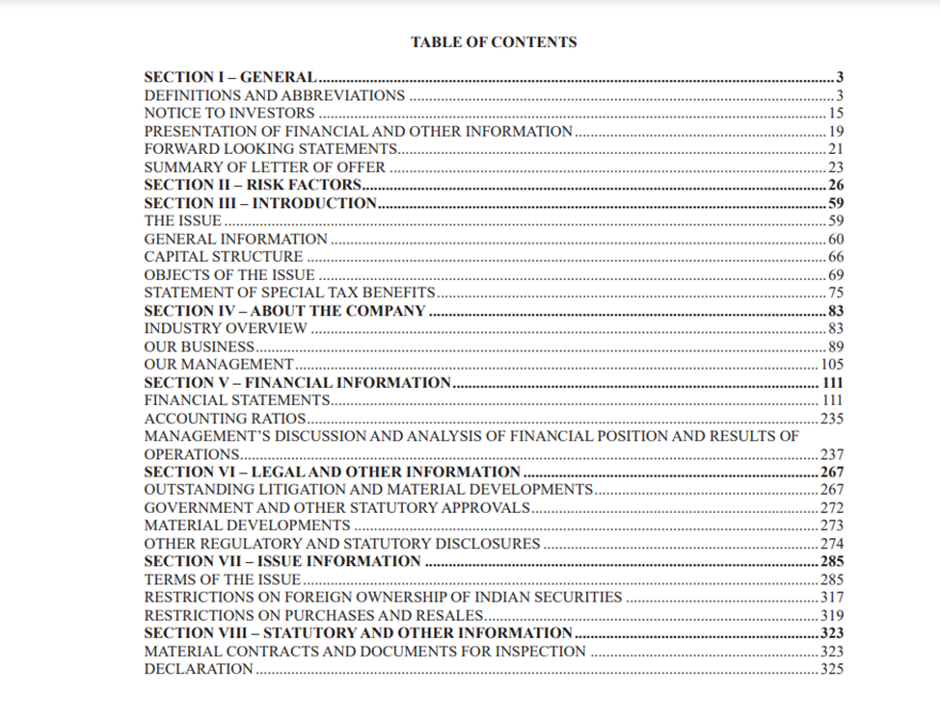

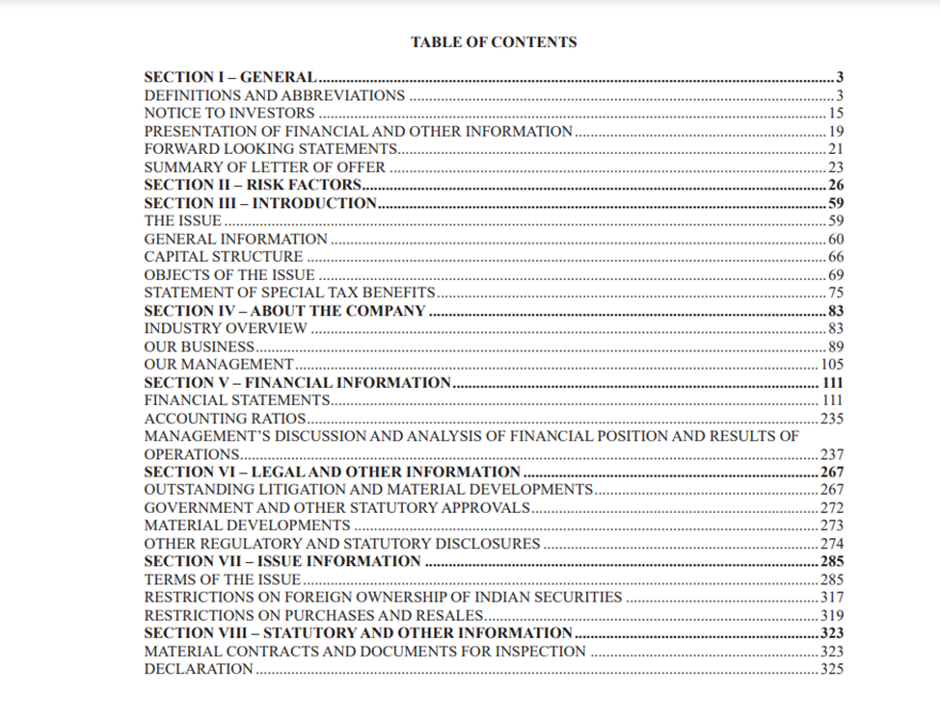

The Rights Issue Offer Letter (LOF) follows a standardised structure prescribed under the SEBI (ICDR) Regulations, 2018.

Below is an overview of the main sections and what they contain:

|

Section

|

Description / Key Details

|

|

1. General

|

Explains the purpose of the document, definitions, and general terms used.

|

|

2. Risk Factors

|

Lists material internal and external risks that could affect the company or investors.

|

|

3. Introduction

|

Includes issue details (number of shares, price, record date), company information, capital structure, and objects of the issue.

|

|

4. About the Company

|

Provides background, business activities, strengths, management, and industry overview.

|

|

5. Financial Information

|

Includes audited financials for the last three years—balance sheet, P&L, cash flow—and key ratios.

|

|

6. Legal and Other Information

|

Covers pending litigations, regulatory approvals, and legal matters.

|

|

7. Issue Information

|

Describes the terms of the issue—rights entitlement, issue price, payment terms, and timelines.

|

|

8. Statutory and Other Information

|

Lists material contracts, consents, and documents for public inspection.

|

Rights Issue - Table of Contents

The Rights Issue Letter of Offer (LOF) contains essential details that help investors make an informed decision. Below is an overview of the main sections and what each covers:

|

Section

|

Purpose & Key Details

|

|

1. The Issue

|

Provides fundamental details about the Rights Issue, including:

- Number of Rights Equity Shares being offered

- Rights Entitlement ratio

- Record Date for eligibility

- Face Value of the shares

- Issue Price

- Outstanding equity shares post-issue

|

|

2. Objects of the Issue

|

Explains why the company is raising funds — e.g., for new projects, working capital, debt repayment, or general corporate purposes. Helps investors assess how the funds will be utilised and whether it aligns with the company’s long-term strategy.

|

|

3. Terms of Payment

|

Clarifies payment methods — whether full payment is due on application or partly paid in tranches through call money. This section ensures transparency on the payment schedule and helps investors plan accordingly.

|

|

4. Our Business

|

Describes the company’s background, products/services, market presence, strengths, and strategic plans. Enables investors to assess business fundamentals, competitive position, and future growth prospects.

|

|

5. Financial Information

|

Summarizes key financial data such as profit and loss, balance sheet, and cash flow statements (usually for the past three years). Helps investors evaluate profitability, leverage, liquidity, and overall financial health.

|

|

6. Issue Schedule (Timeline)

|

Lists important dates in the issue process to help shareholders act within deadlines:

|