NCD Application Process

NCD IPO applications can be filed through the ASBA process, the UPI mechanism and manual paper application forms.

NCD IPO applications can be filed through the ASBA process, the UPI mechanism and manual paper application forms.

Content:

The NCD application process tells us about the procedure and method for applying for an NCD IPO.

In India, NCD IPO applications can be filed through the ASBA process. SEBI also allows individual investors to submit NCD IPO applications for a value of up to Rs 5 lakhs through the UPI mechanism. Another important point to note is that the applications for NCDs can be filed only in dematerialized form.

The procedure for applying for an NCD IPO is very similar to the procedure for applying for an IPO of shares. Investors can apply for NCDs online or offline through self-certified syndicate banks (SCSB) or intermediaries or through the stock exchange. Let us go through the issuance procedure for each mode in detail.

Investors can apply for an NCD IPO online through SCSBs and other intermediaries, including brokers, provided the online facility is provided by the respective intermediaries.

Investors can apply for NCD IPO electronically through the Internet banking facility, provided it is available with the SCSB where the investor's ASBA account is maintained.

The following are the general steps to apply for an NCD IPO through SCSB:

Once the application is submitted, SCSB will upload the offer on the exchange platform and block the funds from the ASBA account.

The investor can apply for the NCD IPO online through NCD intermediaries such as a registered stock broker, provided the broker offers an online application for the NCD IPO. Not many brokers allow you to invest in an NCD IPO online. Currently, very few brokers like Nuvama Wealth (Edelweiss), Angel One and SBI Securities offer the facility to apply for NCD IPOs electronically. You need to check with your broker or intermediary if the online application facility for NCD IPO is available with them.

Steps to apply for NCD IPO through brokers:

The broker uploads the bid on the exchange platform and forwards the required details to SCSB to block the funds in case of an ASBA application.

The BSE and NSE stock exchanges offer retail investors the facility to apply for NCDs online through the UPI mechanism. BSE and NSE have developed a web-based platform and mobile app BSEDirect and NSEgoBID respectively to enable retail investors to apply for NCD bonds up to Rs 5 lakhs using their UPI ID.

The investor has to register once with the NSE/BSE of his choice to make an online application through the exchange. Once the investor submits his bid, it will be automatically uploaded to the bidding platform of the exchange and the amount will be blocked through the UPI mechanism.

Refer to the detailed guidelines on NSEgoBID and BSEDirect for information on the registration process and how to apply for NCDs through the exchange.

Important links :

GoldenPi is a SEBI-registered online bond platform provider and debt broker that allows retail investors to apply for NCD IPOs through the UPI mechanism. You need to register with GoldenPi to apply through their platform.

Steps to invest in NCD IPO through GoldenPi

Indiabonds is India’s fixed-income investment platform that enables investors to easily and conveniently invest in various types of bonds/debt instruments such as high-yield bonds, NCDs, tax-free bonds, Sovereign Gold Bonds, bank bonds and capital gain bonds. Investors can invest through UPI or ASBA.

Steps to apply for NCD IPO with Indiabonds:

Note:

Investors can apply offline by submitting the physical NCD application form to the designated branches of SCSB or intermediaries.

The physical copy of the NCD application form can be obtained from any of the following sources:

Alternatively, the NCD application form can also be downloaded from the websites of the Lead Managers, Stock Exchanges, SEBI, Company and SCSBs.

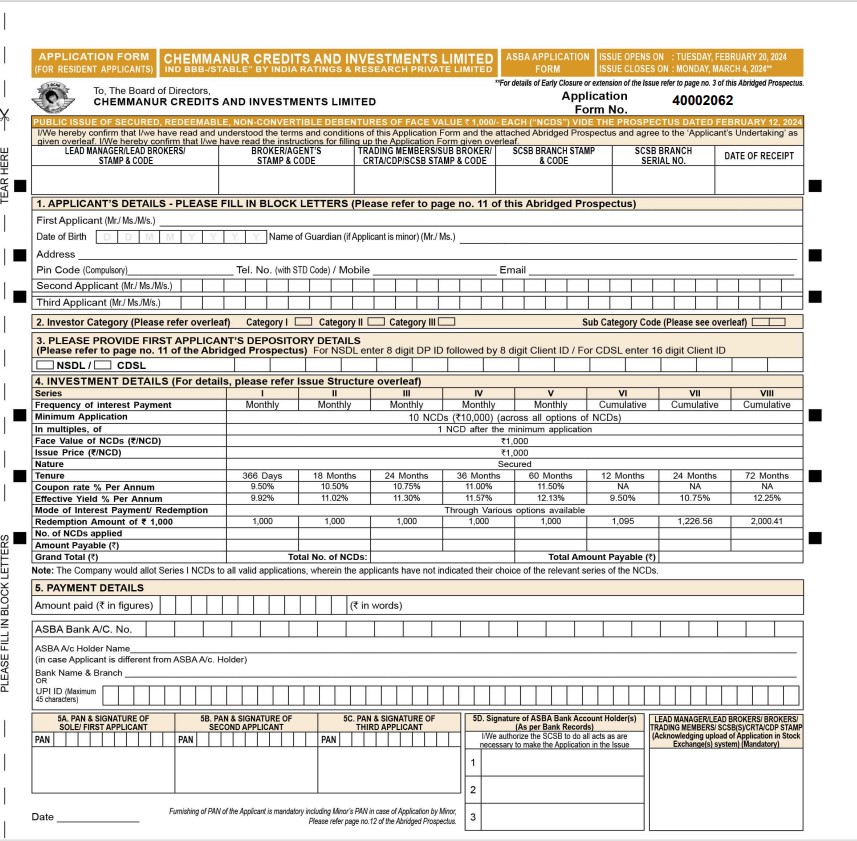

The NCD application form is a two-page document. The first page contains the list of details to be filled in by the applicant and the acknowledgement slip. The second page contains the issue structure, instructions, undertaking details and contact details of the company and the registrar.

A physical application form has a pre-printed unique application number (UAN). In the electronic application form, the UAN is generated automatically at the time of downloading.

The content of the NCD application form

The NCD application status tells you about the status of your application. You can check the status of your NCD application online on the BSE and NSE websites.

To check the status on the BSE website, proceed as follows:

To check the status on NSE follow the below steps:

Note: To avail of the online application check status on NSE, the investor has to register one time with NSE by providing the PAN details.

Companies first issue NCD IPOs and then list on the stock exchange and later trade them on the secondary market. Investors can therefore either subscribe when a company announces an NCD IPO or buy them later in the secondary market when they are traded like shares, but with less liquidity and volatility.

Investors can buy NCDs in the secondary market by using the brokerage platform or internet banking facility of banks that facilitate bond trading.

To track the list of upcoming NCD issues for investment, visit the NCD page of Chittorgarh.com. You can find the details of NCD for application, NCD review, and subscription status all in one place.

All applicants should apply for NCD issuances exclusively through the ASBA process. The following are the ways in which investors can apply for NCDs online:

NSE and BSE offer NSEgoBid and BSEDirect apps/websites through which retail investors can apply for NCDs up to Rs 5 lakhs. Not all brokers and banks offer the facility to apply for NCD online. Therefore, the investor must check with their broker or bank if this facility is available.

To apply for an NCD online, the investor should fill in the NCD bid details online and provide the DP details and bank accounts (ASBA/UPI) as requested. In the case of a UPI application, the investor needs to approve the UPI mandate to complete the application process.

Investors can invest in NCDs both online and offline. Before investing in NCDs, investors should ensure that they have a Demat account with Central Depository Services Limited (CDSL) or National Securities Depository Limited (NSDL). They should apply for the issuance of NCDs only through the ASBA process.

The following are the steps to buy NCDs online in India:

The offline NCD application can be done by following the below steps:

Yes, a demat account is required for NCDs.

The mode of issue of NCD IPO will be in dematerialized form only. Therefore, a demat account is required for the company to credit the securities at the time of allotment.

Some companies allow the issuance of NCDs in physical form at special request, however, trading in NCDs is allowed only in dematerialized form.

Non-convertible debentures can be bought either through the primary market by applying to the NCD IPO or through the secondary market.

The NCD IPO application can be made offline or online through the ASBA mechanism. Retail investors can apply through the UPI mechanism. In the offline process, the investor has to submit the duly filled physical copy of the NCD application form to the nearest intermediary.

In the case of an online application for an NCD IPO, the investor has to enter the NCD details, DP details and payment details online. Not every intermediary allows online applications for NCD IPOs, so you should check with your broker/bank for the online facility.

To buy an NCD in the secondary market, the investor needs to place a buy order through the broker's trading platform, provided the broker offers online trading of NCDs. The investor must search for the desired NCD instrument on the broker's platform and place the order for the desired quantity at the desired price. If the matching order is found, it will be executed.

Yes, you can buy listed NCDs from the stock market.

Trading in NCDs is similar to trading in shares, but the market is not very liquid. To buy NCDs on the stock exchange, please contact your broker. Generally, the broker will allow you to place NCD buy orders via its trading platform.

Yes, Zerodha offers the facility to buy NCDs on the secondary market.

Zerodha currently does not allow applications for NCD IPO through its platform. However, you can use the Zerodha demat account number to apply for an NCD IPO.

Yes, you can buy NCD online.

To apply for an NCD IPO online, you need to have a demat account, ASBA bank account or UPI ID. You can apply for NCD online through the following ways:

Note: Check with your broker/bank if they offer the facility to buy NCD IPO online.

You can buy or invest in NCD IPOs through the following intermediaries:

The exchange platforms are meant for retail investors applying for NCDs through the UPI mechanism.

You can also buy NCDs from the secondary market once they get listed on the stock exchange.

Currently, Zerodha does not allow online applications for NCD IPO through its platform.

Zerodha offers trading in listed NCDs through Kite in the secondary market. Investors can buy or sell listed NCDs, similar to trading shares. You can find the NCD instrument in Kite under the N series.

Groww does not currently offer investment in NCD IPOs or trading in listed NCDs through its trading platform.

However, you can use your demat account details with Groww when you apply for an NCD IPO.

Angel Broking offers to apply for NCD IPOs via the UPI mechanism through their broking platform Angel One.

To apply for NCD IPO with Angel Broking:

Upstox does not currently offer investment in NCD IPOs or trading in listed NCDs through its trading platform.

However, you can use your demat account details with Upstox when you apply for the NCD IPO.