Planning an SME IPO?

End-to-end support from preparation to listing.

Planning an SME IPO?

Content:

IPO allotment is the allocation or distribution of shares to the investors in an IPO. The allocation is determined by the Registrar in consultation with the Exchange . IPO allotment announcement is done by the registrar 3-4 days after the IPO bidding period gets over. Investor could visit registrar's website to check the allotment status.

IPO allotment depends on the demand of IPO shares. If the IPO is oversubscribed (received more bids then the shares offered ), not all investors may receive an allocation. If the IPO is not fully subscribed, all investors will receive allotment.

The IPO allotment mechanism depends on the investor category and the IPO subscription levels.

Note:

Each retail individual investor ( RII ) gets allocated at least one lot; provided there are those many shares reserved for RII in the IPO and the number of RII applicants. IPO shares are allocated in a bunch known as lot. A lot includes x number of shares worth around Rs 15,000 in Mainboard IPO and Rs 1,00,000 in SME IPO . The number of shares in lot ( lot size ) is declared by the issuer company along with the issue price .

The number of maximum retail investors who could get allotment in an IPO is derived by dividing the total number of shares offered in RII reserved category by the lot size .

Maximum RII Allotees = (Total shares offered to RII) / (IPO lot size )

For example; In ideaForge Technology IPO , 842,865 shares were reserved for retail. The lot size of the IPO was 22 shares. Maximum Retail Allotees = 8,42,865 / 22 = 38,312 investors.

IPO Retail Category Basis of Allotment

|

Scenario |

Allotment Process |

|

|---|---|---|

|

1 |

RII category under-subscribed. |

Full allotment to all applicants. |

|

2 |

Total RII applications are greater than maximum retail investors who could get allotment. |

Computerized lottery where the winners get maximum 1 lot of shares. |

|

3 |

Total RII applications are less than maximum retail investors who could get allotment. |

Each retail investor will be allotted at least one lot. The remaining shares will be allocated on a pro-rata basis. |

For example, if a company offers 5 lakhs shares to RII in an IPO with a minimum lot size of 250 shares. In this case, the maximum RII investors to whom the allotment can be made is (500,000/250) 2,000 investors.

Scenario 1: If 1,950 investors apply for 495,000 shares, all investors receive the full allotment because the RII category is not fully subscribed.

Scenario 2: If 2,500 investors apply for 650,000 shares, it is not possible to allocate at least one lot to each investor because there are only 500,000 shares for RII. In this case, the allocation is made by a computerized lottery system.

Scenario 3: If 1,975 investors apply for 525,000 shares, each investor will initially be allocated at least one lot, i.e. 250 shares. Of the remaining [500,000-(1,975*250)] 6,250 shares, the allotment is then made on a proportionate basis.

NII Sub Category

NII IPO investor category is divided in 2 parts:

Each NII investor will be allotted a minimum bid lot as applicable to that category, subject to availability of shares. The minimum bid lot will be equal to the minimum application size for more than Rs 2 lakhs. In case any shares are left after allotment of minimum bid lot, the same will be allotted on a pro-rata basis.

In case of under subscription , all investors will receive the full allotment. The unsubscribed portion of the NII may be used to meet any excess demand from other categories.

Note:

There is no segregation of Big NII and Small NII in SME IPO where DRHPs were filed before 3 rd March 2025. However, for new SME IPOs where DRHPs are filed after 3 rd March 2025, the NII category is divided in two sub categories (similar to mainboard IPO ):

The allotment to QIB investors will be made on a proportionate basis in case of over subscription . In case of an under- subscription , all QIB investors will receive the full allotment. However, the under-subscribed portion in the QIB category cannot be allotted to other investor categories.

The mutual funds in the QIB category will be allotted up to 5% of the QIB category. If the demand for the mutual funds exceeds 5% of the QIB category, the allocation shall be made proportionally up to 5%. However, if mutual fund demand is less than 5% of the QIB category, all mutual funds will receive the full allotment. The remaining unsubscribed portion may be used to meet the demand of other QIB investors on a pro-rata basis for up to 95% of the QIB category.

In mainboard bookbuilding IPOs, anchor investors are offered shares up to 60% of the QIB category. Of the 60%, one-third of the anchor investors ' share is reserved for domestic mutual funds.

The issuer decides on the selection of the anchor investors and their allocation in consultation with the lead manager . The registrar maintains a physical book to record the applications received from Anchor Investors. If the offer price is higher than the Anchor Investor offer price, the anchor investors are sent revised confirmation of allocation note (CAN) for payment of differential amount.

Anchor Reservation Criteria

The issuer must observe the following guidelines when allocating shares to anchor investors.

| Anchor Investor Reservation | Anchor Investor Limit |

|---|---|

|

Up to Rs. 10 crores |

Maximum 2 Anchor Investors. |

|

Rs. 10 crores - Rs. 250 crores |

Minimum 2 and maximum 15 Anchor Investors subject to minimum allotment of Rs 5 crores per Anchor Investor. |

|

Rs 250 crores |

Minimum 5 and maximum 15 anchor investors for allocation up to Rs 250 crores and additional 10 anchor investors for every additional Rs 250 crores subject to minimum allotment of Rs 5 crores per Anchor Investor. |

The allocation to employees will be made on a pro rata basis in the event of over subscription .

The maximum value of allocation to eligible employees shall not exceed Rs 200,000 unless the Employee Reservation Portion is undersubscribed. If the employee quota is not fully subscribed, the unsubscribed portion gets allocated on a proportionate basis to Eligible Employees for value exceeding Rs. 200,000 up to Rs. 500,000.

The allocation to eligible shareholders will be made on proportionate basis in the event of oversubscription .

If an investor has placed a bid in the shareholder category for an amount exceeding Rs 200,000 and also in any other category, then the bid will be considered as multiple bids and will get rejected.

If an investor bids in the shareholder category up to an amount of Rs 200,000, he may also bid in the Employee category (if applicable) up to Rs 200,000 and any other category. Such bids will not be counted as multiple bids and will have a chance to get allotment in respective category as per the criteria explained above for each category.

The registrar of the IPO is responsible for the allotment process. The basis for allotment is finalized by the registrar in consultation with the designated exchanges. The following are the general steps taken by the Registrar to complete the IPO allotment process.

IPO allotment date is the date on which the IPO allotment is announced by the Registrar to the issue . Investors can check the status of their IPO applications on IPO allotment date. The IPO allotment is a key event that investors follow in over-subscribed IPOs where the allotment is made by lottery.

The registrar of the issue uploads the allotment results on its website, where investors can check the status of their allotment by entering the PAN number, IPO application number or demat account number.

The IPO allotment should be completed within five business days of the closing of the offering.

The IPO allotment status check is to determine whether the investor has received the shares or allotment in an IPO. An investor needs either a PAN number, an application number, or a demat account number to check the allotment status. The allotment status is made available online by the Registrar to the Issue on the date of the IPO allotment.

Steps to check IPO allotment status

If investors have received the allotment, the allotment status page on the website will display the number of shares allotted , and if no allotment has been made, the page will be blank.

There is no fixed IPO allotment formula or IPO allotment chances calculator that can guarantee investors an allotment in an IPO. The allotment depends on the level of subscription in the IPO and the investor category in which the investor has applied.

In most IPOs, the allotment is made by lottery because they are oversubscribed . Your chances of receiving an allocation are the same as other applicants.

Although there is no rule of thumb that can guarantee investors an allotment in an IPO, investors can always follow some good practices to increase their chances of allotment as mentioned below:

The basis of allotment is the process that decides the allocation of shares in an IPO to the investors who have applied for it. The basis of allotment is included in the offer document s and is finalized by the registrar, company and lead manager in consultation with the Designated exchanges.

The allotment shall be made according to the pro-rata or lottery system based on the investor category and demand for the IPO.

The Basis of Allotment (BOA) is a document published by the registrar in the leading daily newspaper once the allotment is finalized in consultation with the Designated Exchange/s. The BOA document contains the below details:

Let us take the example of Sah Polymers Limited IPO to understand the basis of allotment document better and understand how the allotment for RII and NII is done.

IPO Details :

|

IPO Price |

Rs 65 |

|

Rs 10 |

|

|

IPO Size |

Rs 66.30 Cr |

|

230 |

Shares Offered :

|

Category |

Shares Offered |

Amount (Rs Cr) |

Size (%) |

|---|---|---|---|

|

Anchor Investor |

4,590,000 |

29.84 |

45.00% |

|

QIB |

3,060,000 |

19.89 |

30.00% |

|

NII |

1,530,000 |

9.95 |

15.00% |

|

bNII (bids above Rs 10L) |

1,020,000 |

6.63 |

10.00% |

|

sNII (bids below Rs 10L) |

510,000 |

3.32 |

5.00% |

|

Retail |

1,020,000 |

6.63 |

10.00% |

|

Total |

10,200,000 |

66.30 |

100% |

Allotment Rule for Retail Category

In above example:

Sah Polymers Limited BOA Document Extract of RII

| Sr. No | Category | No. of Applications Received | % of Total | Total No. of Equity Shares Applied | % to Total | No. of Equity Shares Allotted per Bidder | Ratio | Total No. of Equity Shares Allotted | No. Of allottees per category |

|---|---|---|---|---|---|---|---|---|---|

| 1 | 230 | 1,27,218 | 91.54 | 2,92,60,140 | 74.29 | 230 | 3:94 | 933800 | 4060 |

| 2 | 460 | 6,600 | 4.75 | 30,36,000 | 7.71 | 230 | 3:94 | 48,530 | 211 |

| 3 | 690 | 1,780 | 1.28 | 12,28,200 | 3.12 | 230 | 57:1780 | 13,110 | 57 |

| 4 | 920 | 797 | 0.57 | 7,33,240 | 1.86 | 230 | 25:797 | 5,750 | 25 |

| 5 | 1150 | 716 | 0.52 | 8,23,400 | 2.09 | 230 | 23:716 | 5,290 | 23 |

| 6 | 1360 | 293 | 0.21 | 4,04,340 | 1.03 | 230 | 0.5784722 | 2,070 | 9 |

| 7 | 1610 | 295 | 0.21 | 4,74,950 | 1.21 | 230 | 0.5798611 | 2,070 | 9 |

| 8 | 1840 | 103 | 0.07 | 1,89,520 | 0.48 | 230 | 0.1965278 | 690 | 3 |

| 9 | 2070 | 53 | 0.04 | 1,09,710 | 0.28 | 230 | 0.1201389 | 460 | 2 |

| 10 | 2300 | 254 | 0.18 | 5,84,200 | 1.48 | 230 | 0.5097222 | 1,840 | 8 |

| 11 | 2530 | 41 | 0.03 | 1,03,730 | 0.26 | 230 | 0.0701389 | 230 | 1 |

| 12 | 2760 | 59 | 0.04 | 1,62,840 | 0.41 | 230 | 0.1243056 | 460 | 2 |

| 13 | 2990 | 762 | 0.55 | 22,78,380 | 5.78 | 230 | 24:762 | 5,520 | 24 |

| 374 Allottees from Serial no 2 to 13 Additional 1(one) share | 1 | 90:187 | 180 | ||||||

| TOTAL | 1,38,971 | 100 | 3,93,88,650 | 100 | 1020000 | ||||

Points to Note:

The above quoted example is of a Mainboard IPO. In an SME IPO , the basis of allotment for RII is much simpler and easier . There is generally one category of shares in which RIIs apply due to the higher minimum lot size application.

Let us take example of Crayons Advertising Limited SME IPO to understand this better.

The minimum and maximum bid lot for RII is of 2000 shares. The issue price is Rs.62- Rs.65. The number of shares reserved for RIIs is 2,138,000. Thus, the number of maximum RIIs to whom the minimum bid lot will be allotted is derived by dividing 2138000 by 2000=1069

In the below Crayons Advertising IPO RII BOA extract, we can see that of 178,602 applications received, 1069 bidders will be picked by draw of computerized lottery and allotted 2000 shares.

Crayons Advertising Limited SME IPO BOA Document Extract of RII

|

No. of Shares Applied For (Category Wise) |

No. of Applications Received |

% of Total |

Total No. of Shares Applied in Each Category |

% of Total |

No. of Equity Shares Allotted per Applicant |

Ratio |

Total No. of Shares Allotted |

|---|---|---|---|---|---|---|---|

|

2000 |

1,78,602 |

100 |

35,72,04,000 |

100 |

2000 |

1,069:1,78,602 |

21.38,000 |

|

Total |

1,768,602 |

100 |

35,72,04,000 |

100 |

21,38,000 |

The allotment calculation for the small and big NII categories is similar to that for the RII category.

NII Allotment Rule :

Minimum allotment in NII (sNII & bNII) per bidder = 3,220 shares (Rs 209,300)

Small NII Category Allotment

Sah Polymers BOA Extract of Small NII (Rs 2 Lakhs to Rs 10 lakhs)

| Sr. No. | Category | No. of Applications Received | % of Total | Total No. of Equity Shares applied | % to Total | No. of Equity Shares Allotted per Bidder | Ratio | Total No. of Equity Shares allotted | Number of allottees per category |

|---|---|---|---|---|---|---|---|---|---|

| 1 | 3,220 | 4318 | 94.32 | 1,39,03,960 | 89.84 | 3,220 | 149:4318 | 479780 | 149 |

| 2 | 3,450 | 77 | 1.68 | 2,65,650 | 1.72 | 3,357 | 3:77 | 10,071 | 3 |

| 3 | 3,680 | 35 | 0.76 | 1,28,800 | 0.83 | 3,357 | 1:35 | 3,357 | 1 |

| 4 | 3,910 | 4 | 0.09 | 15,640 | 0.1 | 3,357 | 0:04 | 0 | - |

| 5 | 4,140 | 3 | 0.07 | 12,420 | 0.08 | 3,357 | 0:03 | 0 | - |

| 6 | 4,370 | 2 | 0.04 | 8,740 | 0.06 | 3,357 | 0:02 | 0 | - |

| 7 | 4,600 | 26 | 0.57 | 1,19,600 | 0.77 | 3,357 | 1:26 | 3,357 | 1 |

| 8 | 4,830 | 6 | 0.13 | 28,980 | 0.19 | 3,357 | 0:06 | 0 | - |

| 9 | 5,060 | 2 | 0.04 | 10,120 | 0.07 | 3,357 | 0:02 | 0 | - |

| 10 | 5,750 | 11 | 0.24 | 63,250 | 0.41 | 3,357 | 0:11 | 0 | - |

| 11 | 5,980 | 1 | 0.02 | 5 980 | 0.04 | 3,357 | 0:01 | 0 | - |

| 12 | 6,210 | 1 | 0.02 | 6,210 | 0.04 | 3,357 | 0:01 | 0 | - |

| 13 | 6,440 | 13 | 0.28 | 83,720 | 0.54 | 3,357 | 1:13 | 3,357 | 1 |

| 14 | 6,900 | 16 | 0.35 | 1,10,400 | 0.71 | 3,357 | 1:16 | 3,357 | 1 |

| 15 | 7,130 | 2 | 0.04 | 14,260 | 0.09 | 3,357 | 0:02 | 0 | - |

| 16 | 7,360 | 1 | 0.02 | 7,360 | 0.05 | 3,357 | 0:01 | 0 | - |

| 17 | 7,590 | 12 | 0.26 | 91,080 | 0.59 | 3,357 | 1:12 | 3,357 | 1 |

| 18 | 7,820 | 2 | 0.04 | 15,640 | 10 | 3,357 | 0:02 | 0 | - |

| 19 | 8,050 | 2 | 0.04 | 16,100 | 0.1 | 3,357 | 0:02 | 0 | - |

| 20 | 8,970 | 1 | 0.02 | 8,970 | 0.06 | 3,357 | 0:01 | 0 | - |

| 21 | 9,200 | 6 | 0.13 | 55,200 | 0.36 | 3,357 | 0:06 | 0 | - |

| 22 | 9,660 | 1 | 0.02 | 9,660 | 0.06 | 3,357 | 0:01 | 0 | - |

| 23 | 10,120 | 1 | 0.02 | 10,120 | 0.07 | 3,357 | 0:01 | 0 | - |

| 24 | 10,350 | 1 | 0 02 | 10,350 | 0.07 | 3,357 | 0:01 | 0 | - |

| 25 | 10,810 | 1 | 0.02 | 10,810 | 0.07 | 3,357 | 0:01 | 0 | - |

| 26 | 11,040 | 1 | 0.02 | 11,040 | 0.07 | 3,357 | 0:01 | 0 | - |

| 27 | 11,500 | 3 | 0.07 | 34,500 | 0.22 | 3,357 | 0:03 | 0 | - |

| 28 | 11,960 | 1 | 0.02 | 11,960 | 0.08 | 3,357 | 0:01 | 0 | - |

| 29 | 12,420 | 1 | 0.02 | 12,420 | 0.08 | 3,357 | 0:01 | 0 | - |

| 30 | 12,650 | 1 | 0.02 | 12,650 | 0.08 | 3,357 | 0:01 | 0 | - |

| 31 | 12,880 | 2 | 0.04 | 25,760 | 0.17 | 3,357 | 0:02 | 0 | - |

| 32 | 13,800 | 2 | 0.04 | 27,600 | 0.18 | 3,357 | 0:02 | 0 | - |

| 33 | 14,030 | 2 | 0.04 | 28,060 | 18 | 3,357 | 0:02 | 0 | - |

| 34 | 14,490 | 5 | 0.11 | 72,450 | 0.47 | 3,357 | 0:05 | 0 | - |

| 35 | 14,950 | 3 | 0.07 | 44,850 | 0.29 | 3,357 | 0:03 | 0 | - |

| 36 | 15,180 | 12 | 0.26 | 1,82,160 | 1.18 | 3,357 | 1:12 | 3,357 | 1 |

| All allottees from Serial no 2 to 36 for 1 (one) additional share | 1 | 7:09 | 7 | ||||||

| TOTAL | 4578 | 100 | 1,54,76,470 | 100 | 5,10,000 | ||||

Points to Note:

The above is an example of Mainboard NII BOA . In SME IPO , the allotment to NII is done on proportionate basis such that each allotted NII receives minimum bid lot. There is no classification of Small NII and Big NII in SMEs.

Let us continue with the example of Crayons Advertising IPO, to understand SME IPO BOA for NIIs .

The number of shares reserved for NIIs is 918,000. If we see the below extract:

Note: Below table is applicable for DRHPs filed before 3rd March 2025.

|

No. of Shares Applied for (Category wise) |

Number of Applications Received |

% of Total |

Total No. of Shares Applied in Each Category |

% of Total |

No. of Equity Shares Alloted per Apllicant |

Ration of allottees to applicants |

Total No. of Shares Allotted |

|

|---|---|---|---|---|---|---|---|---|

|

4000 |

3412 |

53.01 |

13648000 |

6.43 |

2000 |

15 |

1706 |

60000 |

|

6000 |

511 |

7.93 |

3066000 |

1.45 |

2000 |

1 |

73 |

14000 |

|

8000 |

243 |

3.77 |

1944000 |

0.92 |

2000 |

4 |

243 |

8000 |

|

10000 |

199 |

3.09 |

1990000 |

0.94 |

2000 |

4 |

199 |

8000 |

|

12000 |

164 |

2.54 |

1968000 |

0.93 |

2000 |

1 |

41 |

8000 |

|

14000 |

146 |

2.26 |

2044000 |

0.96 |

2000 |

2 |

73 |

8000 |

|

16000 |

503 |

7.81 |

8048000 |

3.8 |

2000 |

17 |

503 |

34000 |

|

18000 |

108 |

1.67 |

1944000 |

0.92 |

2000 |

1 |

27 |

8000 |

|

20000 |

156 |

2.42 |

3120000 |

1.47 |

2000 |

7 |

156 |

14000 |

|

No. of shares reserved for NII |

No. of shares applied for |

% of total shares applied |

No. of shares to be alloted |

No. of shares to be allotted after rounding to nearest multiple 2000 |

Minimum number of shares allotted to each applicant |

Number of applicants to receive allotment |

|

918,000 |

6,000 |

1.45 |

13,311.00 |

14,000 |

2,000 |

7 |

|

918,000 |

8,000 |

0.92 |

8445.60 |

8,000 |

2,000 |

4 |

|

918,000 |

10,000 |

0.94 |

8,629.20 |

8,000 |

2,000 |

4 |

|

918,000 |

12,000 |

0.93 |

8,537.40 |

8,000 |

2,000 |

4 |

|

918,000 |

14,000 |

0.96 |

8812.80 |

8,000 |

2,000 |

4 |

|

918,000 |

16,000 |

3.80 |

34,884.00 |

34,000 |

2,000 |

17 |

|

918,000 |

18,000 |

0.92 |

8,445.60 |

8,000 |

2,000 |

4 |

|

918,000 |

20,000 |

1.47 |

13,494.60 |

14,000 |

2,000 |

7 |

|

No. of Shares Applied for (Category wise) |

Number of Applications Received |

% of Total |

Total No. of Shares Applied in Each Category |

% of Total |

No. of Equity Shares Alloted per Apllicant |

Ration of allottees to applicants |

Total No. of Shares Allotted |

|

|---|---|---|---|---|---|---|---|---|

| 54000 | 1 | 0.01 | 54000 | 0.03 | 0 | 0 | 1 | 0 |

| 56000 | 8 | 0.12 | 448000 | 0.21 | 2000 | 1 | 8 | 2000 |

| 58000 | 1 | 0.01 | 58000 | 0.03 | 0 | 0 | 1 | 0 |

|

No. of Shares Applied for (Category wise) |

Number of Applications Received |

% of Total |

Total No. of Shares Applied in Each Category |

% of Total |

No. of Equity Shares Alloted per Apllicant |

Ration of allottees to applicants |

Total No. of Shares Allotted |

|

|---|---|---|---|---|---|---|---|---|

|

3054000 |

2 |

0.03 |

6108000 |

2.87 |

12000 |

1 |

1 |

24000 |

|

3054000 |

0 |

0 |

0 |

0 |

2000 |

1 |

2 |

2000 |

|

3054000 |

4 |

0.06 |

12224000 |

5.76 |

12000 |

1 |

1 |

48000 |

|

3054000 |

0 |

0 |

0 |

0 |

2000 |

2 |

4 |

4000 |

| Total | 6436 | 100 | 212102000 | 100 | 918000 | |||

However, for SME IPOs where DRHPs are filed after 8th March 2025, SEBI has aligned the sNII and bNII allocation methodology with that of mainboard IPOs. That is, first allotment will be made by way of a draw of lots (in case of oversubscription ) for the minimum bid lot to successful applicants, and then any balance shares, if available, will be allotted on a proportionate basis.

Refer to the snapshot of NR Vandana BOA for small NIIs (upto Rs. 10 lakhs).

| Sr No | No of Shares Applied for (Category wise) | No. of Applications Received | % to Total (Applications) | Total No. of Equity Shares Applied | % to Total (Shares Applied) | No. of Equity Shares Allotted Per Bidder | Ratio | Number of successful applicants (after rounding) | % to total (Successful Applicants) | Total No. of shares allocated/allotted | % to total (Shares Allotted) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 9000 | 1710 | 79.51 | 15390000 | 68.93 | 9000 | 26:1710 | 26 | 78.75 | 234000 | 78.75 |

| 2 | 12000 | 173 | 8.05 | 2076000 | 9.30 | 9000 | 3:173 | 3 | 9.10 | 27000 | 9.10 |

| 3 | 15000 | 83 | 3.87 | 1245000 | 5.58 | 9000 | 1:83 | 1 | 3.04 | 9000 | 3.04 |

| 4 | 18000 | 84 | 3.91 | 1512000 | 6.78 | 9000 | 1:84 | 1 | 3.04 | 9000 | 3.04 |

| 5 | 21000 | 100 | 4.66 | 2100000 | 9.41 | 9000 | 2:100 | 2 | 6.07 | 18000 | 6.07 |

| Total | 2150 | 100 | 22323000 | 100 | 33 | 100 | 297000 | 100 |

Thus, to conclude if we observe the BOA for Mainboard IPOs and SME IPOs we see below key difference:

In Mainboard IPOs, the allotment to NIIs is done based on the maximum bNII and sNII allottees to whom the minimum NII lot can be allotted and in case of SME, there is no derivation of maximum NII allottees, the allotment is done in proportion of shares reserved for the NIIs and thereafter the minimum bid lot is allotted.

Another point to note is the difference in the number of shares reserved for RII and Other category in SME IPO in the offer documents versus the number of shares allotted to respective category in the Basis of Allotment (BOA). It is generally seen that the number of shares reserved for each investor category in the offer document matches the number of shares reserved or available for allotment as per BOA. However in case of SME Fixed price issues the reservation proportion gets adjusted proportionately as per the number of shares applied by each category provided the subscription by retail category is greater than the others category.

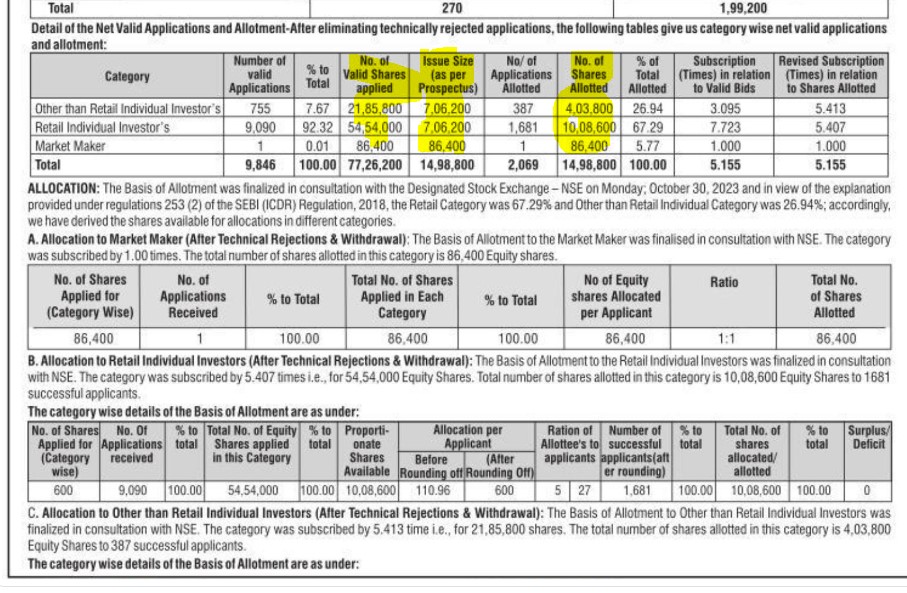

Let us take the example of On Door Concepts SME Fixed Price Issue to understand it better.

On Door Concepts IPO Basis of Allotment

|

Investor Category |

Shares reserved as per RHP |

No. of shares applied as per BOA |

|---|---|---|

|

Issue Size |

1,498,800 |

|

|

86,400 |

86,400 |

|

|

Net Issue to Public |

1,412,400 |

|

|

RII |

706,200 |

5,454,000 |

|

Other than RII |

706,200 |

2,185,800 |

In the above table, we can see that as per RHP the split between RII and Others is 50-50% of Net Issue to public. The total number of shares applied by RII and Others is 7,639,800. However, the number of shares applied by RII is greater than Others. Thus, the number of shares available for allotment will also get proportionately adjusted based on these numbers.

Shares available for allotment for RII = Shares applied by RII/Total number of shares applied *Net Issue to Public = 5,454,000/7,639,800 *1,412,400 = 1,008,303. This will be rounded to nearest lot size . Lot size in this case is 600 shares. Thus, the number of shares allotted to RII will be 1008,600 which tallies as per the BOA extract below.

Shares available for allotment for Other than RII = Shares applied by Other than RII/Total number of shares applied *Net Issue to Public = 2,185,800/7,639,800 *1,412,400 = 404,098. This will be rounded to nearest lot size of 600. Thus, the number of shares allotted to Other than RII will be 403,800 which tallies as per the BOA extract below.

Note: The above logic gets applied only to SME Fixed Price Issues when RII subscription number is greater than Other than RII numbers.

The maximum RII allottee is the number of maximum retail individual investors who will receive allotment in an IPO.

As per the SEBI rule, each RII investor should receive minimum one lot. Thus, to achieve this, the number of shares offered /reserved for RIIs in an IPO is divided by the lot size to know the maximum number of RII to whom the shares will be allotted.

The Allotment Confirmation is the letter, notice or communication of allotment of shares to the Anchor Investors who secured an allotment.

A stock exchange that the issuer selects for a particular issue or on which its securities are listed. The exchange being considered for listing is called the designated exchange. For example, ABC Ltd will list its new shares on the BSE. Here, the BSE is the designated exchange.

Ready to list?

Let's make it happen!

IPO allotment is the process of allocating shares to investors who have applied for shares in an IPO.

The allotment process is carried out by the Registrar. Allotment in an IPO is not guaranteed and depends on the category of investor and the level of subscription.

A company must complete the allotment process within five business days of the closing of the offering.

There are several ways to find out if you have received your IPO allotment.

Each retail (RII) and non-institutional investor (NII) should get the minimum bid lot subject to the availability of shares. Thus, if the number of RII and NII investors is less than the maximum number of RII and NII allottees, each investor will be allotted minimum bid lot initially. Thereafter the allotment will be made on a pro-rata basis. If, on the other hand, the number of applicants is higher than the number of allottees, the allotment will be made using pro rata and draw of lots.

The allotment to QIBs and other reserved categories is done on a proportionate basis. The registrar finalizes the basis of allotment in consultation with the Designated exchanges.

Allotment to anchor investors shall be made at the discretion of the issuer in consultation with the lead manager.

The issuer is required to complete the refund process within four working days and allotment process within five working days of the closing of the issue.

For example, if the offering window for the IPO closes on March 15, 2023, the issuer will have to refund the funds in case of non-allotment by March 21, 2023, and credit the shares to the Demat account of allotted shareholders by March 22, 2023.

You can visit IPO allotment status page at Chittorgarh.com website to get the details of each IPO along with their allotment schedule.

The Chittorgarh app also sends notification once the allotment is out. Steps to check the allotment status.

The website will display the details of the allotted shares if you have received an allotment under an IPO.

The IPO allotment status tells you whether or not you have received shares in an IPO.

The IPO allotment status will be published as soon as the basis of allotment has been determined by the Registrar in consultation with the designated stock exchanges.

Investors can check the IPO allotment status either on the registrar's website, the exchange website or on Chittorgarh.com, where full details of each IPO can be found.

The IPO allotment status in NSE is available on the NSE Bid Verification and Allotment Details Page.

Steps to check the IPO allotment in NSE:

Points to Note:

The IPO allotment is finalized by the Registrar in consultation with the designated stock exchanges.

The IPO allotment is based on the category of the investor and the level of subscription. The Registrar has to follow the guidelines laid down by SEBI for IPO allotment.

There is no set process or rule to get guaranteed allotment in an IPO unless it is undersubscribed.

You can increase your chances of receiving an allocation by following the below best practices:

IPO allotment status is not available until the registrar finalizes the allotment.

If you check the allotment status once you have applied for the IPO or immediately after the IPO closing date, the IPO allotment status will not be available.

The IPO allotment will be made within five business days after the closing of the offering. Look for the basis of allotment date on Chittorgarh.com and check for the allotment post that date.

You may not receive an allotment because a large number of shares have been oversubscribed. In such cases, the allotment is based on a computerized lottery system.

Apart from oversubscription, there are several other reasons why you may not receive an allotment.

The IPO allotment is subject to the availability of shares. It is also required that you have submitted a valid application in a timely manner.

IPO allotment is not guaranteed. The allotment depends on the level of oversubscription and investor category.

A valid application is the one with,

IPO allotment works based on the investor category and the level of oversubscription.

If an IPO is not fully subscribed, each investor gets full allotment. However, if the IPO is oversubscribed the allotment is made either on lottery basis or pro-rata basis.

| Investor Category | IPO Allotment Method |

|---|---|

|

Retail Individual Investor (RII) |

|

|

Non-Institutional Investors (NII) |

|

|

Proportionate basis |

|

|

Discretionary basis |

|

|

Employees |

Proportionate basis |

|

Shareholder |

Proportionate basis |

IPO allotment is based on the below conditions:

You can find your IPO allotment information on the registrar's website, the exchanges, or on the Chittorgarh website or mobile app.

You can check for the IPO allotment status post the basis of the allotment date. The allotment status will be available after 3 working days after the closing date of the issue. You need a PAN, DP ID or IPO application number to check the allotment status.

You may also receive an SMS or email from the exchanges or from DP informing you of your allotment status.

If you have received shares in the IPO, the websites will display the details of the shares allotted. If you did not receive an allotment, the allotment details will either be blank or indicate that no shares were allotted.

The next step after IPO allotment is the processing of refunds, crediting of shares to the Demat account of allottees and finally listing.

The registrar coordinates with banks to process refunds in case of non-allotment or partial allotment. The Registrar also instructs the depositories to credit the shares to the Demat account of the allottees and banks to debit the required amount.

Once the shares are listed on the stock exchanges, investors can either sell their shares or hold them depending on their analysis.

Schedule post IPO allotment

The IPO allotment fails on account of various reasons as mentioned below:

You can follow below good practices to increase your chances to get IPO allotment.

You may sell the shares allotted under the IPO at any time on or after the listing date. It is up to the investors to decide whether to hold the shares or sell them on the listing date.

If the listing price is higher than the issue price, investors may sell their shares if they realise the targeted profit. They can also hold the shares if they know that prices will continue to rise.

If the stock market price is below the issue price, investors can hold the shares and sell them later when prices rise.

The IPO allotment is completed within five working days of the close of the offer. The basis of allotment is finalized after 3 business days of issue closure.

For example, if an IPO closes on April 6, 2023, the share allotment will be completed by April 17, 2023.

Trading/bank holidays and weekends are not taken into account when deriving the above dates.

You can check the detailed IPO schedule of each IPO on Chittorgarh.com.

The IPO allotment process is allocation of shares to the IPO investors based on the availability of shares.

If an IPO is not fully subscribed, all the investors in an IPO receive full allotment.

If an IPO is oversubscribed, the allotment happens either on a proportionate basis or a lottery basis depending on the investor category and subscription level.

Few points to note in the process of allotment :

The allotment status of the IPO can be checked 3-4 business days after the IPO is completed.

Investors can check the allotment status by looking at the allotment date.

For example, the basis of allotment date of Sah Polymers Limited was January 9, 2023. So the allotment status is usually available at the end of January 9 or January 10. The process of crediting the shares to the Demat account of the allottees is completed on January 11.

IPO allotment is random in case of retail investors and non-institutional investors when the number of applicants exceeds the number of allottees to whom the minimum bid lot can be allotted.

The maximum number of allottees is derived by dividing the total number of shares reserved for the category (RII/NII) with the minimum lot size applicable to that category.

For example, the issue lot size is 25 and the number of shares offered to is 4 lakhs. Based on the lot size, the maximum number of investors to whom a lot can be allocated would be 16,000 (400,000/25). However, if 20,000 investors apply for the IPO, it is not possible to allocate minimum 25 shares to each investor; in this case, the allocation will be made at random using the computerized lottery system.

The allotment to QIBs happens on a proportionate basis.

IPO allotment is based on luck only when there is over subscription.

As per SEBI guidelines, each retail investor should get at least one lot subject to availability of shares. But, if the number of retail investors is more than the number to whom one lot can be allotted, the allotment is done based on lottery method. In the computerized lottery method, allocation is random and only the lucky ones receive an allocation.

The same rule is applicable for Non-institutional investors (NII), wherein each NII should get the minimum bid lot. Thus, if the number of NII applicants is less than NII allottees in case of oversubscription, first minimum one lot is allotted and remaining on pro-rata. However, if NII applicants are more than NII allottees, allotment happens using draw of lots along with pro-rata system.

In the case of QIB and other reserved category of investors, the allocation is made on a pro rata basis. Thus, if an investor's investment share is significantly less compared to the oversubscription, he/she may not receive any allotment.

Everyone receives an allotment if an IPO is not fully subscribed or only partially subscribed.

In the case of oversubscription, allocation to everyone is based on the level of oversubscription and the investor category. As per SEBI guidelines, each RII and NII should get the minimum bid lot subject to availability of shares. In case of oversubscription, if the number of applicants is more than the number of allottees to whom the minimum bid lot can be allotted, the allotment happens by draw of lots. In such cases, only the lucky ones will receive the allotment. However, if the number of applicants is less than the number of allottees, the allotment happens on a pro-rata basis.

In the case of QIBs and other reserved categories, not all investors will receive an allotment if the proportion of investment is very low compared to the oversubscription.

Yes, lot size matters in an IPO because lot size is one of the factors considered in the allotment of shares.

It is important to apply for an IPO with a minimum lot size or a multiple thereof. Allocation of shares is done in the form of lots, and only the leftover shares are allocated as 1 share or so.

No, IPO allotment is done by the registrar.

A broker is an intermediary that simply provides the trading platform for IPO application. In an IPO, the broker's role is to submit bids to the exchange.

The registrar is responsible for the entire allocation process. The Registrar finalizes the basis of allotment in consultation with the designated exchanges. Once the basis of allotment is determined, the Registrar instructs the banks to debit the bank accounts of the allottees and arrange for a refund in case of non-/partial allotment.

You may not be getting IPO allotment on account of below reasons:

Basis of allotment is a document that gives detailed information of allotment across each investor category.

The basis of allotment provides below details:

The basis of the allotment date in an IPO is the date on which the registrar publishes the basis of allotment post finalization with the designated exchanges.

The basis of the allotment date is three working days after the issue closes for subscription.

You can check the basis of allotment date for each IPO on Chittorgarh.com.

The subscription level and investor category determines the IPO allotment.

Below factors are taken into account while allocating shares in an IPO.