Published on Wednesday, August 4, 2021 by Chittorgarh.com Team | Modified on Friday, December 26, 2025

Investing in IPOs can be a high-reward opportunity, especially for High Net-Worth Individuals (HNIs) who fall under the NII (Non-Institutional Investor) category. Any investor who wants to invest more than Rs 2 lakh in the mainboard IPO and bid for at least 3 lots in the SME IPO can submit an IPO bid under the NII category.

This article will provide a complete HNI IPO Guide explaining the step-by-step HNI IPO Application process, IPO allotment rules for HNIs, HNI IPO funding and practical tips for HNIs.

But before you jump in, let’s first understand who are HNI/NII investors are in IPO.

Investors who bid for IPO shares above Rs 2 lakh are considered as HNI or NII. However, in SME IPO, investors must bid for 3 lots (requires minimum investment above Rs 2 lakh) to submit IPO applications under the NII category.

HNI and NIIs are the same, as both fall under the NII investor category. Indian residents, NRIs, HUFs, companies, and Trusts can participate in IPO under the NII category.

In book-building mainboard and SME IPOs, atleast 15% of the issue size is reserved for NII quota. While in fixed-price issues, up to 50% shares are reserved for subscription by NIIs.

NIIs are further classified as; small NII (sNII) and big NII (bNII).

HNIs can submit IPO applications via two methods:

HNI IPO applications up to Rs 5 lakh can be submitted through UPI.

ASBA (Applications Supported by Blocked Amount) is a facility provided by a bank to apply for IPOs. HNIs can apply for IPO using the ASBA process via their net banking portal.

HNIs must know before applying in IPO:

HNI IPO allotment is generally done on a proportionate basis. It means larger applications are allotted with bigger number of shares, if oversubscribed.

SEBI also introduced the lottery-based allotment to small NIIs for heavily oversubscribed IPOs. So, the allotment method may sometimes differ for big and small NIIs. The lottery-based allotment mechanism was introduced to give small NII bidders a chance of being allotted.

Proportionate Allotment: Allotment is calculated based on the number of shares applied relative to total NII applications.

When the company receives NII applications for a higher number of shares than shares available in the NII Quota, the allotment is done on a proportionate basis.Means each NII applicant will receive a pro-rata allotment based on their IPO bids.

HNI IPO Allotment ratio = (Shares reserved for NIIs/Total Shares Applied by NIIs)

Suppose a company has 10,00,000 shares reserved under NII Quota, and NIIs have bid for a total of 50,00,000 shares. Shares applied by an HNI is 1,00,000, so the pro-rata allotment will be for:

= (10,00,000/50,00,000)*1,00,000

= 20,000 shares

So the NII who applied for 1,00,000 shares, would receive 20,000 shares as proportionate allotment.

Lottery system: In certain cases, especially when the oversubscription under sNII (sHNI) is extremely high, and the allotment cannot be done proportionately due to logistical or regulatory reasons, the process may turn into a lottery system. This typically happens in the case of very high oversubscription.

Ifan IPO has 10,000 shares reserved under the NII quota, and the company has received an equal or lower number of bids from NII, each applicant will get full allotment for the shares they have applied for.

Example

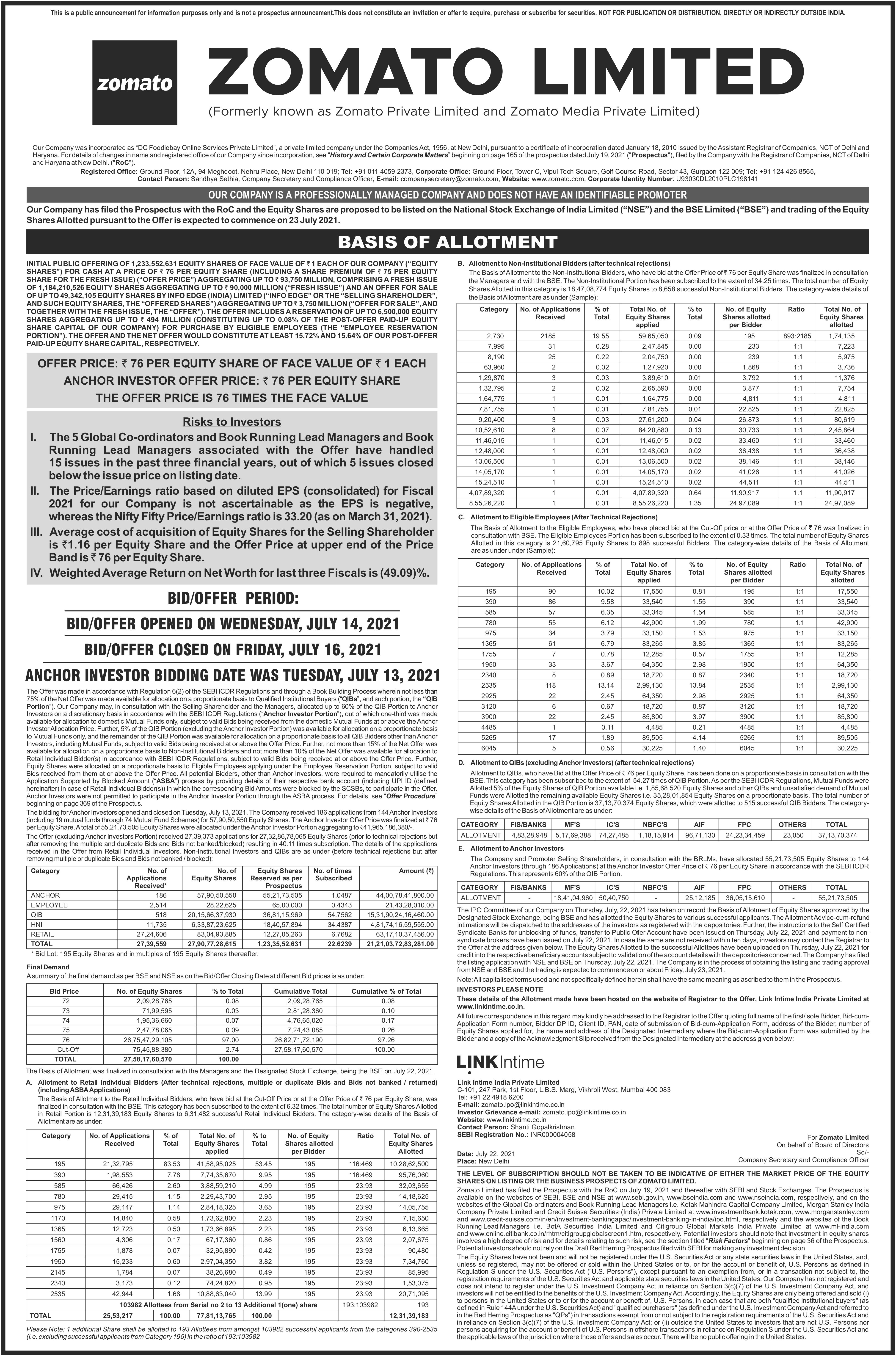

|

Rs 76 |

|

|

Issue Size |

Rs 9375 Cr |

|

195 |

|

|

One Lot Price |

195*76 = Rs 14820 |

|

NII Subscription |

34.25 Times |

|

Minimum Lots for HNI |

14 (Rs 2.07L) |

|

Category* |

Lots Applied |

Applications Received |

Shares allotted per bidder |

Allotment Ratio |

|---|---|---|---|---|

|

2,730 |

14 |

2185 |

195 |

893:2185 |

|

7,995 |

41 |

31 |

233 |

1:1 |

|

8,190 |

42 |

25 |

239 |

1:1 |

|

63,960 |

328 |

2 |

1,868 |

1:1 |

|

129,870 |

666 |

3 |

3,792 |

1:1 |

|

132,795 |

681 |

2 |

3,877 |

1:1 |

|

164,775 |

845 |

1 |

4,811 |

1:1 |

|

781,755 |

4009 |

1 |

22,825 |

1:1 |

|

920,400 |

4720 |

3 |

26,873 |

1:1 |

|

1,052,610 |

5398 |

8 |

30,733 |

1:1 |

|

1,146,015 |

5877 |

1 |

33,460 |

1:1 |

|

1,248,000 |

6400 |

1 |

36,438 |

1:1 |

|

1,306,500 |

6700 |

1 |

38,146 |

1:1 |

|

1,405,170 |

7206 |

1 |

41,026 |

1:1 |

|

1,524,510 |

7818 |

1 |

44,511 |

1:1 |

|

40,789,320 |

209176 |

1 |

1190917 |

1:1 |

|

85,526,220 |

438596 |

1 |

2497089 |

1:1 |

* Category in the above table is a group of applications based on the shares applied in lots by investors. Unlike the RII with 13 categories (due to 13 lots); NII has a wide range of categories. Only a few are shown on the basis of the allotment document. That's the reason the Basis of allotment document says 'The category-wise details of the Basis of Allotment are as under (Sample):'

|

Name |

Applied Qty |

Lots |

Price |

Total Value |

|

|---|---|---|---|---|---|

|

ZOMATO LIMITED |

70200 |

360 |

76 |

53,35,200 |

2050 |

In the above sample allotment

Shares Allotted = (360 Lots Applied / 34.25 Times NII Oversubscription) * 195 Shares per lot = 2050

HNI IPO funding means borrowing short-term loan to apply for IPO shares in the NII / HNI category, with the expectation of listing gains. These are usually 7-day loan offered by NBFCs, private financiers, or some banks.

How IPO funding for HNI investors work?

HNI IPO Funding Cost = Loan Amount * Daily Interest rate * No. of funded days

HNI IPO Funding amount – 10 Lakh

Interest rate = 0.05% per day

Duration = 7 days

= 10,00,000*0.05%*7 days

= Rs 3,500

So, the funding cost is 3,500.

Refer our HNI IPO Funding Calculator for more details.

Higher allotment chances for larger HNI applications.

Both High Net-worth Individuals (HNI) and Retail Individual Investors (RII) are individual people who apply for an IPO under two different reserved categories i.e. Retail and NII.

The Retail Portion is reserved for individuals who apply for not more than Rs 200,000 in an IPO. The HNI's are individuals who apply for more than Rs 200,000. The HNI bids are considered under the (Non-Institutional Investor) NII portion.

|

Retail Investors |

High net-worth individuals (HNI)/Non-Institutional Investors (NII) |

|

|

Eligibility |

Resident Indian individuals and NRIs applying for shares not exceed Rs 2 Lakh in mainboard IPO and applying for 2 lots in SME IPO. |

Resident Indian individuals and NRIs applying for IPOs worth more than Rs 2 Lakh in mainboard IPO and applying for minimum 3 lots in SME IPO. |

|

Shares Available |

Not less than 35% of the Offer |

Not less than 15% of the Offer. Out of total NII reservation, 1/3rd is reserved for SNIIs and 2/3rd for big NIIs. |

|

Lottery. A maximum number of bidders will be allotted 1 lot. In the case of oversubscription, the chance of getting 1 lot is the same for an individual applied for one lot of Rs 15k or multiple lots up to Rs 2L. |

Proportionate But if you applied for fewer lots than the number of times issue oversubscribed, a lottery is drawn for one lot allotment. For example, if the IPO is subscribed 100 times in NII and an HNI applied for 90 lots, the allotment is done by lottery. |

|

|

cut-off price |

Allowed to invest at the cut-off price. |

Not allowed to use the cut-off price option. HNIs have to specify the exact price at which they would like to buy the IPO shares. |

|

Withdraw or lower the Bids |

Retail investors are allowed to withdraw or lower the bids |

HNIs are not allowed to withdraw or lower the bids. They can modify to increase the application amount. |

No, you cannot apply for both Retail and HNI categories for an IPO. The PAN number used in the application should be unique in an IPO. If you make two applications using the same PAN number, both applications will be rejected.

Note that if a retail investor applies for more than Rs 2 Lakhs of shares in an IPO, the bid is considered as an HNI bid in the (Non-Institutional Investors) NII category.

Yes, any resident individual or non-resident individual (NRI) can apply in the HNI category. The HNI category is also known as Non-Individual Investors or NII.

A retail IPO application of more than Rs 2 Lakh is considered an HNI application. The shares for this application are allocated under the (Non-Institutional Investors) NII category.

Note:

ICICI Direct offers online IPO applications for retail and HNI investors. You could also use ICICI Bank Net Banking to apply for an IPO. The benefit of using the ICICI Bank Net Banking IPO Application is, it allows you to use your demat account with other brokers.

Steps to Apply in HNI Category ICICI Direct

State Bank of India (SBI) offers online IPO applications for retail and HNI investors through its Net Banking facility. SBI offers 3rd Party IPO applications which means you could apply up to 5 IPO applications from the same bank account in an IPO. The 3rd Party IPO Application is the only way to apply in an IPO online for Minors, HUF, Corporate, etc.

Steps to Apply in HNI Category ICICI Direct

Zerodha doesn't provide an IPO application for the HNI category. A stockbroker like Zerodha, Angel, Upstox, and Groww doesn't offer banking services. They offer UPI as a payment option for IPO applications. As UPI has a transaction limit of Rs 2L max, you cannot use UPI as a payment option for the HNI IPO application.

If you have a Zerodha Demat Account, you could apply IPO in the HNI category using two ways:

Steps to apply IPO in HNI Category in Zerodha

The allocated shares are transferred to your Zerodha demat account. You could sell them on the day of listing. The funds remain locked in your bank account and withdrawn at the time of allotment for allocated shares.

The minimum amount for HNI IPO applications in the NII category is Rs 2 lakh. Any retail IPO application with over Rs 2 lakh is considered in HNI or (Non-Institutional Investor) NII category.

The maximum bid in the NII category is the number of Equity Shares in the given lots not exceeding the size of the Offer (excluding the QIB Portion).

No, you cannot apply for IPO in the HNI category through UPI. The UPI payment gateway has a universal transaction limit of Rs 2 Lakh while the HNI application should be above Rs 2 Lakh.

Following are two options available for HNI's to apply in IPOs:

You can apply for IPO in HNI using ASBA offered by the net-banking facility of banks. All banks including public and private banks offer online IPO facilities on their net banking website and mobile app.

You could visit the bank branch and apply in the paper form.

Investment in the HNI category of IPO is a high-risk investment. An investor should have an understanding of risks and rewards when investing in this category.

Risks in applying in HNI Category

Most HNIs take IPO funding loans to invest in IPO. There are a few risks with this:

The IPO shares start trading in the market in 7 to 10 days. A lot can happen in those days. In case the market turns adverse in 10 days, you may incur huge losses on the listing day.

The shares in the NII category for HNIs are allotted by the lottery system if the number of lots applied is less than NII over-subscription. In this case, you may not get the allotment. Even if you get it, it will be just one lot.

HNIs with cash of 10-50 lakhs in their savings bank could apply with their funds. In this case, the risk is low but the chances of allotment are minimal too. Good IPO subscribes 300 to 1000 times in the NII category.

HNIs are not permitted to revise or cancel the bid once placed. Most HNI's apply at the last minute.

HNIs are not permitted to apply at the cut-off price. They have to place the bid at a fixed price in the give price band. The HNIs doesn't get any allotment if the bid price is less than the price fixed for the IPO shares.

HNIs take a calculated risk on IPO funding. They calculate and estimate how much subscriptions will be in the HNI category. They apply for 10 to 20 times higher lots than subscriptions with the funded amount.

Example:

Note in the above calculation, HNI has to estimate:

This is one of the key factors in calculating the grey market premium (GMP) of IPO shares.

HNIs take short-term loans of a few crores to a few hundred crore rupees to apply in an IPO. These loans are issued by public and private sector banks, NBFC, and other financial institutions.

Most of these large-size loans come at around 7% to 8% per annum interest rate. They are issued for 7 days.

The interest rate on IPO funding varies by:

HNI is part of the NII investor category. The basis of allotment for HNI depends on the type of IPO issue and the subscription levels.

In case of a mainboard IPO, the basis of allotment for HNI is as given below:

Note:

In an SME IPO, allotment to HNI/NII is done on pro-rata basis such that each allotted NII gets a minimum bid lot. In an SME IPO, there is no sNII or bNII.

Further details and examples can be found under Basis of Allocation.

Splitting the funds into two HNI IPO applications in an IPO does increase the chance of getting 2 lots but it also increases the chance of getting 0 lots. You could choose this strategy if you like the higher chance of getting 1 lot rather than increased chances of getting 2 lots.

Below is a calculation posted by our IPO forum member IPOLogic to support the above view:

You don't split the money. So, individual oversubscription factor = 30/100 = 0.3 lot

i. chances of getting 0 lot: = (1 - 0.30) = 70 %

ii. chances of getting 1 lot: = 0.30 = 30%

iii chances of getting 2 lot: = 0%

iv chances of getting at least 1 lot = 1 - 70% = 30%

So, if you want some chance to have 2 lots, then it increases your chance of getting 0 lots.

Thus, it will decrease the chance of getting at least 1 lot too.

To get a confirmed allotment in the HNI category, you need to apply for more lots than the final issue over-subscription figure. But the challenge is, to do this; you will have to guess how many times the IPO will oversubscribe in NII (HNI) Category.

The IPO allotment in the Non-Institutional Investors (NII) category for HNIs is done either on a proportionate basis or lottery system. The allotment process is based on the number of lots applied and over-subscription in the NII category.

Let's understand this using three scenarios. Assume an IPO oversubscribed 100 times.

|

Lots Applied |

|

|

20 |

by lottery |

|

80 |

by lottery |

|

100 |

1 lot |

|

350 |

3.5 lots |

|

1000 |

10 lots |

The HNI IPO allotment calculator can help you derive the number of shares/lots to be applied for, to get confirmed allotment based on the estimated oversubscription figure.

It's not easy to predict the subscription level of an IPO. The subscription level depends on factors like the issuer company fundaments, issue size, issue prices, grey market premium and market conditions.

Some analysts guess IPO over-subscription levels before IPO closes to estimate the HNI IPO Shares cost. But their prediction keeps changing until the last minute.

Most good IPOs get heavily over-subscribed in the range of 300 to 1000 times under the NII category (HNI) and 15 to 30 times in the retail category by application.

The oversubscription also depends on the demand in the grey market. The higher the demand for an IPO in the grey market, the higher are the chances of it getting oversubscribed.

It is difficult to derive the expected over-subscription of an IPO based on the historic data as there are too many variables to it.