Published on Wednesday, July 18, 2012 by Chittorgarh.com Team | Modified on Sunday, August 9, 2020

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

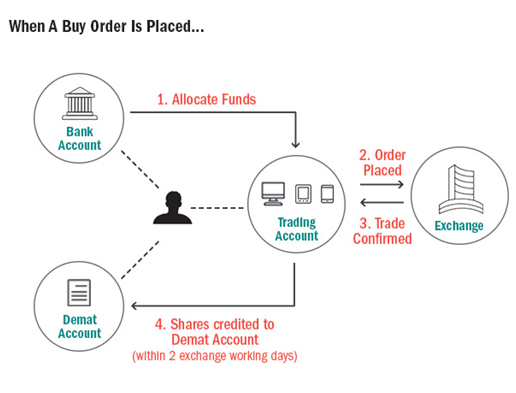

The 3-in-1 account consists of 3 separate accounts open together including a Bank Account (a normal bank account where your money resides), a Trading Account (a share broker account which allows you to trade in equity, F&O etc. segments) and a Demat account (it holds the equity shares purchased by you).

3-in-1 Account = Bank Account + Trading Account + Demat Account

The beauty of 3-in-1 account is seamless transaction between these three accounts. It also offers a wide range of investment products under this account.

When the account holder buy shares through trading account; the money gets automatically debited from the saving bank account and share are automatically credited to the demat account. Similar way when shares are sold through trading account; the money gets credited to the bank account and shares are withdrawn from demat account. The money remains in your bank account can be used like any normal bank account (i.e. you can withdraw that using your debit card).

While the cost of trading is generally high with the companies offering 3-in-1 account, the hassle-free investing and integrated financial solution provides unique benefits. These accounts are especially good for people who invest in the stock market for long term basis or people who do not mind paying a little more brokerage for the hassle-free service.

If you are a beginner in the stock market or an investor in the market (not a regular trader) then this type of account is highly recommended.

Other benefits of 3-in-1 account include:

ICICI 3-in-1 trading account is the oldest and most popular service provided by ICICI Bank. Their strong network of branches makes this account very attractive. HDFC 3-in-1 trading account is another very popular and equally good service provider. SBI 3 in 1 account and standard chartered 3 in 1 account are also provides good investment options.

To know more about the services offered by these companies, their reviews, complaints and rating; please visit the broker page through the link below:

Note: If you already have a saving bank account or demat account, it can be linked to trading account to make it 3-in-1 trading account.

People who are new to trading and wish to open a trading account, frequently ask these questions-

If you wish to open a trading account to trade in stocks, derivatives, IPO etc., you have two choices- 2-in-1 account and 3-in-1 account.

A 3-in-1 account includes a savings account from a bank, a demat account with either of the central depositories NSDL and CDSL and a trading account to buy and sell various financial instruments. All the accounts are jointly opened by a broker. Normally 3-in-1 accounts are offered by broking companies which are a part of a banking group like HDFC Securities, ICICI direct, Kotak Securities and Axis Securities.

A 2-in-1 account includes only a demat account and a trading account. There is no bank account linked to this account. A 2-in-1 account is generally offered by a non-banking broking company like Zerodha, Sharekhan, Indiabulls etc.

The only difference between a 3-in-1 account and a 2-in-1 account is the inclusion of a bank account in the package and the convenience it offers to a trader. Rest all remain same. The trading and the demat account offer same facilities in both types of account.

From trading convenience point of view, a 3-in-1 account works better than a 2-in-1 account. You need 3 things to trade in a financial instrument-

If you open a 3-in-1 account then it is easy and fast for you to move funds between your bank and trading account. The transfer of funds happen in real-time. So if you see a trading opportunity, and there aren't enough funds in your trading account, then you can quickly transfer the funds and execute your trade.

If you open a 2-in-1 account then you have to transfer your funds from other bank account to your trading account. This transfer can take time between a few hours to a day depending on whether you are transferring funds via IMPS, NEFT or a cheque. The broker or the bank may also charge you a fee for fund transfer.

So the choice between a 2-in-1 account or a 3-in-1 account comes down to your convenience.

All major banks SBI, ICICI, Axis, Kotak, HDFC etc., who have a brokerage company in its group offer 3-in-1 accounts. The features of most of the 3-in-1 accounts are similar. However, there are a few factors to consider while choosing the best 3-in-1 account-